Prague, Czech Republic – The European Commission’s RePowerEU plan is set to downplay the risks of a surge in liquified natural gas (LNG) project proposals that could result in an excessive increase in import capacity across Europe, according to the latest data in Global Energy Monitor’s Europe Gas Crisis Tracker.

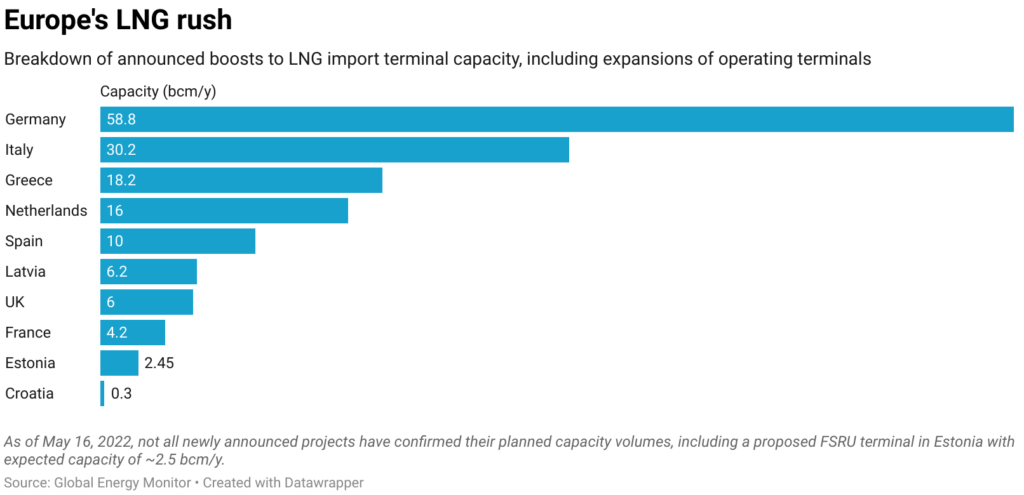

The Europe Gas Crisis Tracker identifies 26 LNG terminals, terminal expansion projects, and floating storage and regasification units (FSRUs) in ten European countries, 22 of which have been announced, proposed or revived since February 2022.

Despite some gaps in project information, these projects would boost import capacity by at least 152 billion cubic meters per year (bcm/y), at a cost of at least 6 billion euros.

This potential capacity increase is significantly at odds with recent analysis showing that the EU has enough gas import capacity – both operating and in development prior to the war in Ukraine – to get off Russian gas. [1]

Since the Commission proposed the outline of RePowerEU on March 8 this year, in which the aim of diversified LNG supply of 50 bcm/y from non-Russian sources was discussed, 93 bcm/y of new LNG import capacity has been announced and proposed, which is over 60% of the total additional new capacity identified in the Europe Gas Crisis Tracker.

Leaks of the RePowerEU plan show that Russian gas imports can be ended through various measures, including demand reduction and, according to the Commission’s modeling, only limited additional gas import infrastructure in the near-term.

Plans for a small number of new LNG projects, FSRUs in Estonia, Germany, and the Netherlands, appear in drafts of RePowerEU, expected to be published on May 18. For the projects in question, there have been clear indications from project promoters that the floating terminals are planned as precursors to permanent onshore terminals, which would result in fossil fuel lock-in.

Greig Aitken, Research analyst with Global Energy Monitor, said: “As the announcements for even more gas import capacity across Europe continue to stack up, the risks are mounting that little regard is being shown to the EU’s ambition to cut gas demand in the near term under the Fit for 55 package.

“The initial RePowerEU proposal in March helped catalyze the stampede of LNG proposals we see now. The Commission can downplay this reality, but it must ensure that the funding mechanisms in the new plan are geared towards energy demand reduction and renewable energy, rather than locking-in fossil fuels with unnecessary LNG expansions.”

Contact

Greig Aitken, Research analyst, Global Energy Monitor

Email: [email protected]

Mobile: +420 607 084 093

Notes for editors

- See: ‘Does phasing-out Russian gas require new gas infrastructure?’ Artelys, May 4, 2022