Tracking coal plant retirements

In order to meet the Paris Agreement goals and put the world on a pathway to no more than 1.5°C of global warming, all existing coal plants must be retired by 2030 in the world’s richest countries, and by 2040 everywhere.

Global Energy Monitor (GEM) estimates that 126 gigawatts (GW) of coal power must be retired each year for the next 17 years to meet this goal, the equivalent of about two coal plants per week.

While the net trend shows that coal capacity is still increasing, threatening the world’s climate goals, each year more operating coal capacity is captured by new unit-level retirement plans or country-level coal phaseout commitments.

Explore the data visualizations below for an insight into the status of the global coal phaseout, changes in coal power capacity over the past two decades, and shifts since the 2015 Paris Agreement.

In GEM’s Global Coal Plant Tracker, coal capacity is considered retired if it has been permanently decommissioned or converted to another fuel – it is important to note that conversions such as coal-to-gas switching also threaten climate goals. In the tools in this page, it is assumed that commitments to retire before 2030 are in line with Paris Agreement for OECD countries and before 2040 for non-OECD countries, even though earlier commitments may be necessary.

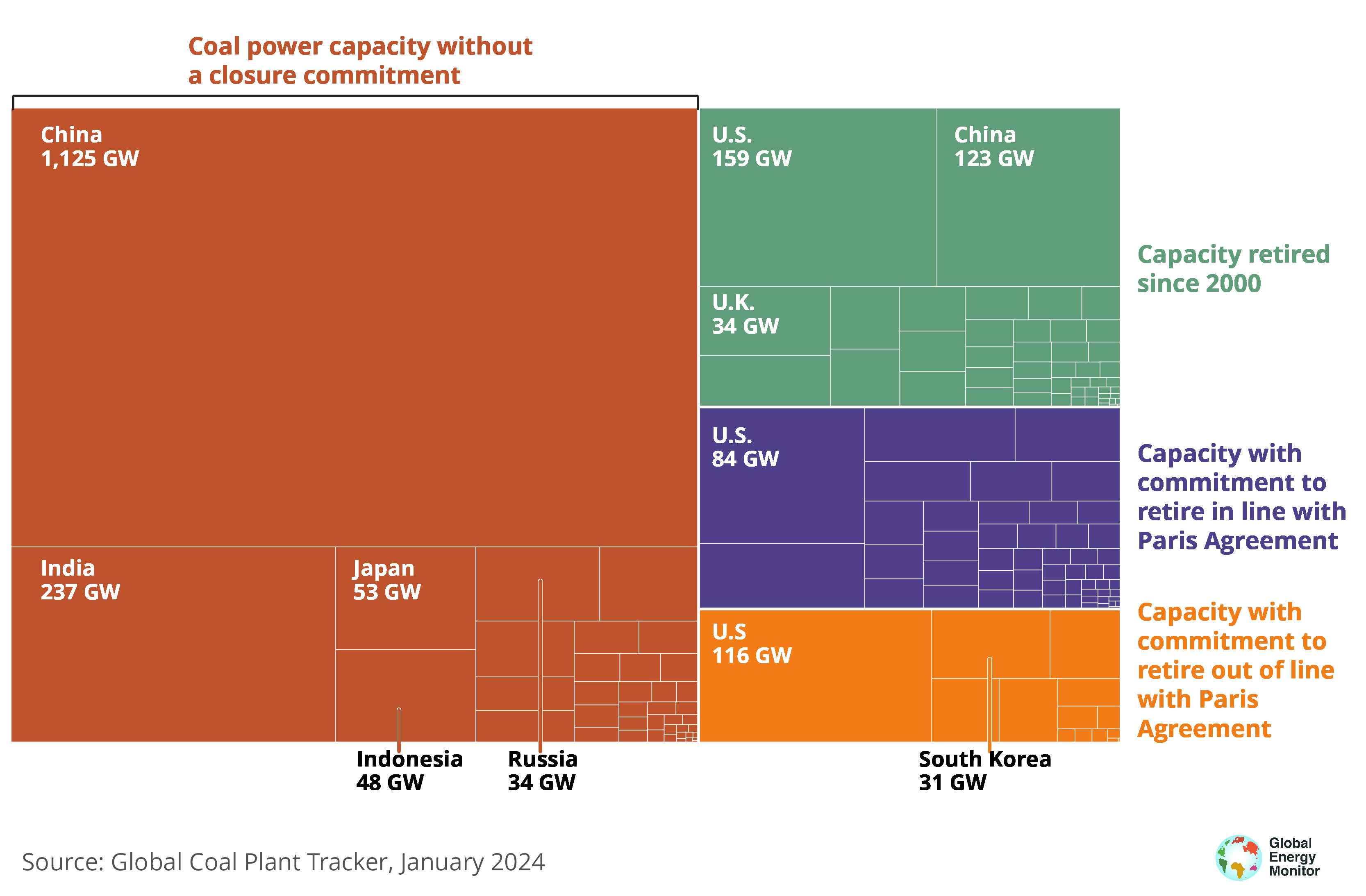

Most coal power capacity needs a closure commitment

Coal-fired power capacity by phaseout status, excluding net zero commitments

A listing of the country level coal phaseout commitments and assumptions used are available here, as well as other recommended resources for the US, Europe, and beyond. GEM has categorized global information using the July 2023 Global Coal Plant Tracker release for illustrative purposes, and recommends further plant and country review to derive phaseout and Paris alignment conclusions from these tools.

Zoom in to map below and hover or click on each circle to see more details about the coal power unit, including where units have retired since 2000, where existing coal units are located, and where they are already expected to retire.

Only five countries have increased coal power capacity under development since 2015, and the biggest eight-year increase did not exceed 3 GW. In contrast, in China, India, and Türkiye, coal power capacity under development between 2015 and 2023 decreased by more than 300 GW, 200 GW, and 50 GW respectively.

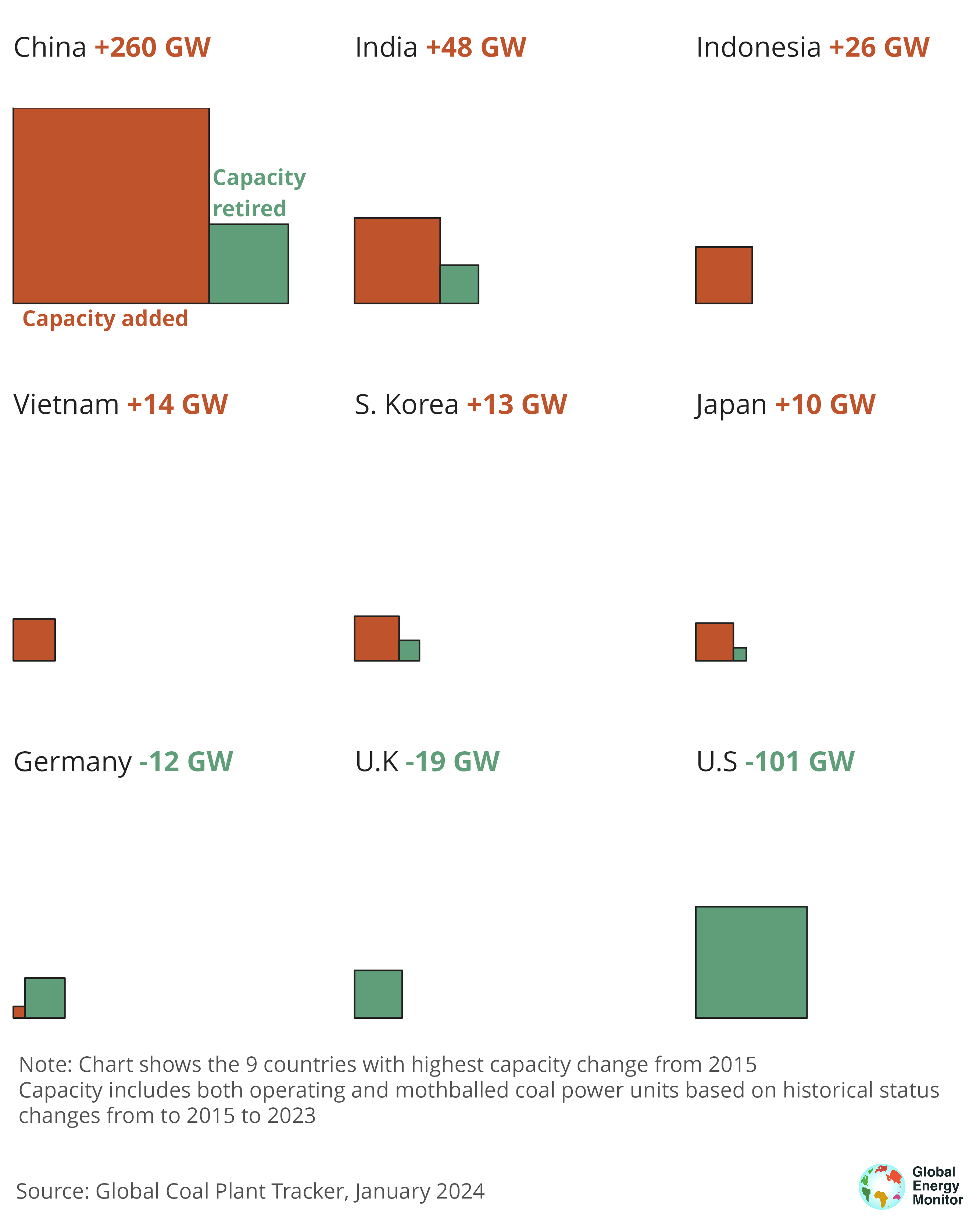

But despite the number of countries that have decreased their coal power capacity and cancelled plans for new coal, the world’s coal power capacity has actually grown 11% since 2015. The number of new coal power plants coming online has outpaced plant closures over the past eight years.

Nearly twice as much coal power capacity has been added globally than retired since Paris.

Coal power capacity additions have outpaced retirements since Paris Agreement

Total operating coal-fired power capacity added and capacity retired since 2015; numbers show net change

For an interactive breakdown of annual coal capacity added and retired by country from 2000 to 2023, visit GEM’s Global Coal Plant Tracker dashboard.

Coal-fired power generation is another helpful indicator to assess progress towards reducing power sector emissions. For example, looking at generation instead of capacity, half of the world’s economies are already at least five years past a peak in power generation from fossil fuels, with emissions from these 107 power sectors falling by almost 20% in the last decade.

Information on generation trends, as well as country-by-country statistics and summaries, are available via the Bloomberg Coal Countdown or Ember’s electricity explorer.