Key points

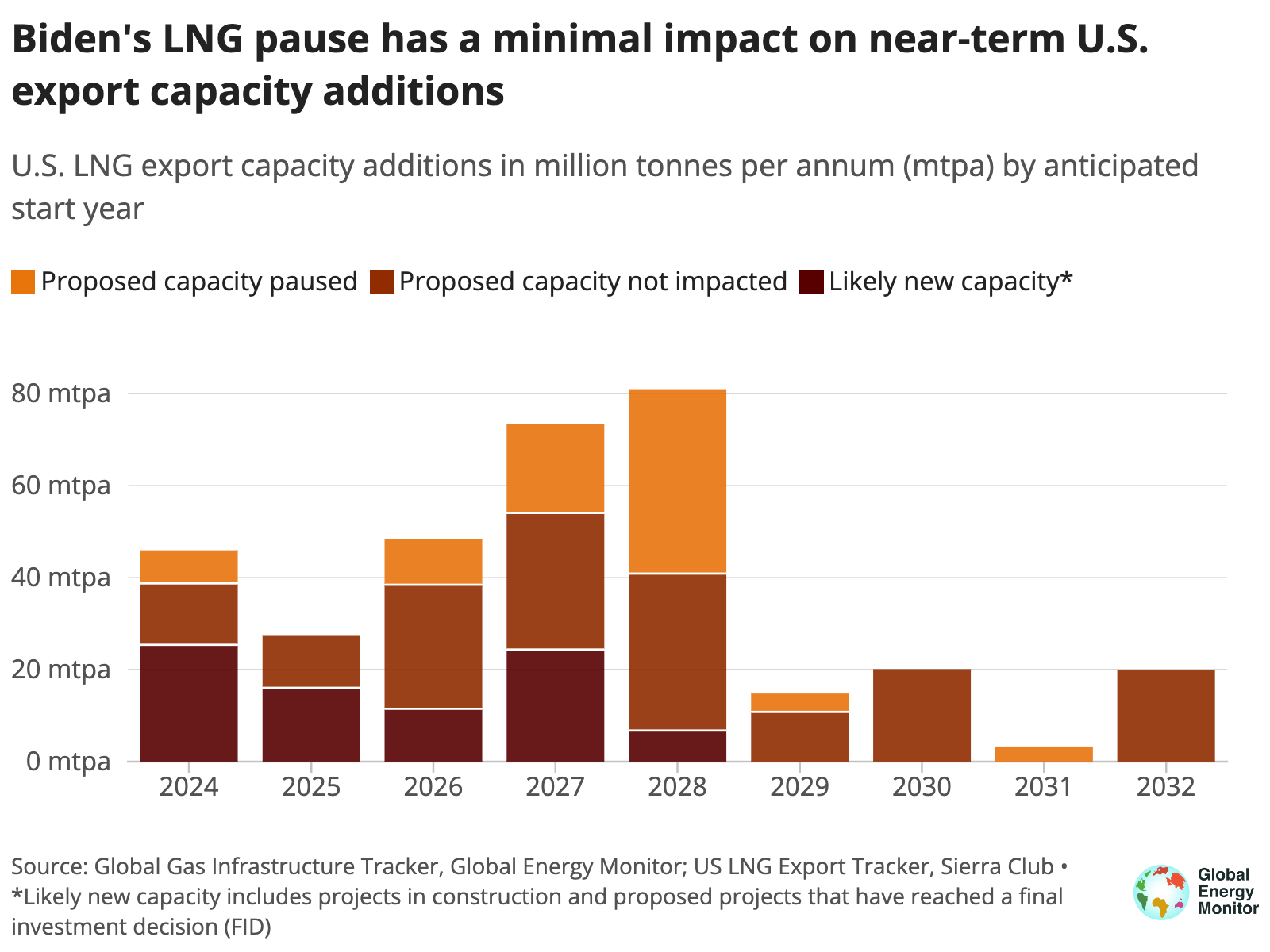

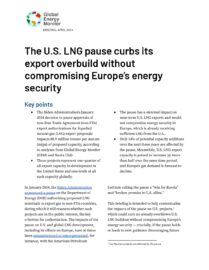

- The Biden Administration’s January 2024 decision to pause approvals of non-Free Trade Agreement (non-FTA) export authorizations for liquefied natural gas (LNG) export proposals impacts 88.9 million tonnes per annum (mtpa) of proposed capacity, according to analyses from Global Energy Monitor (GEM) and Sierra Club.

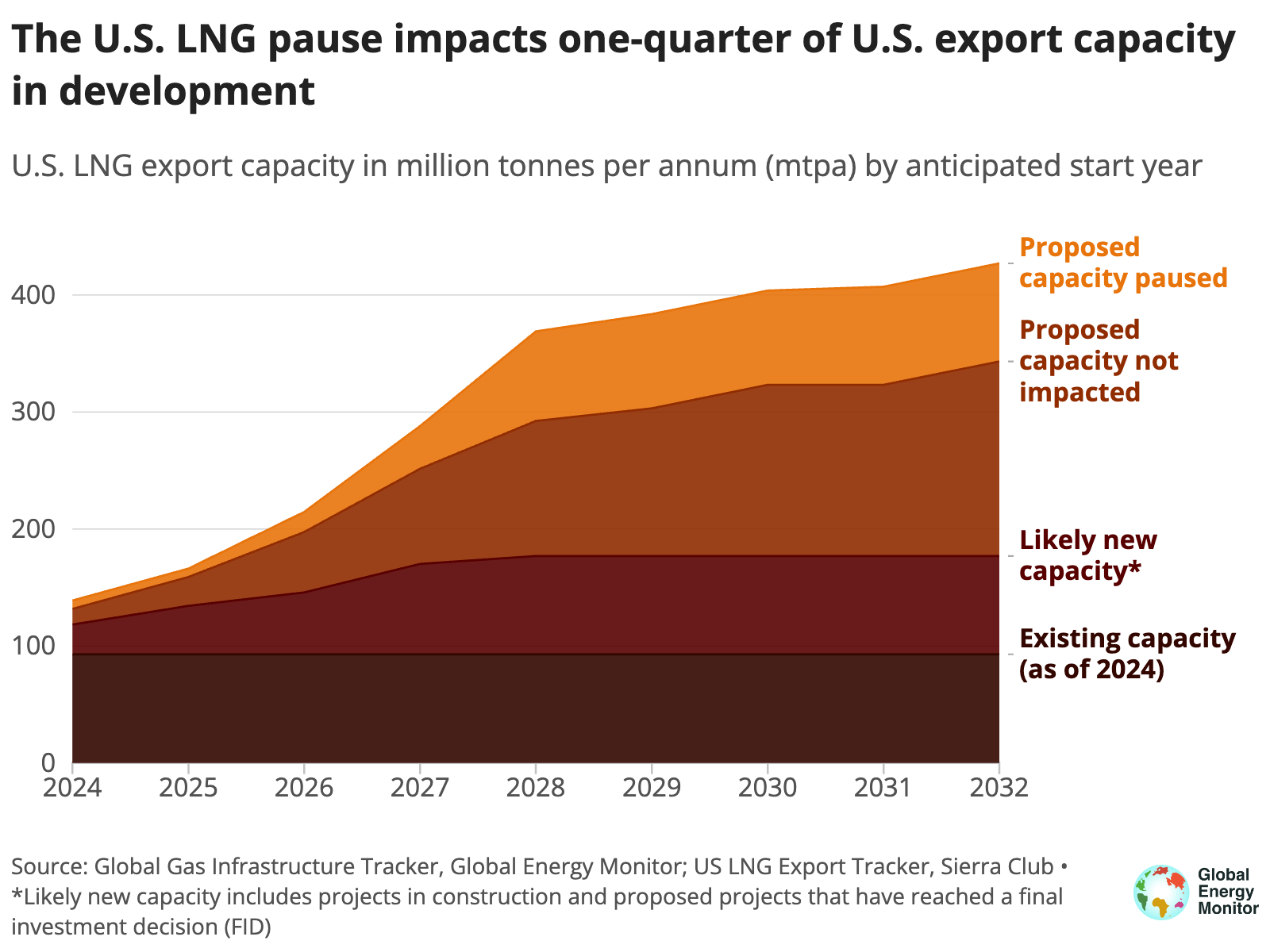

- These projects represent one-quarter of all export capacity in development in the United States and one-tenth of all such capacity globally.

- The pause has a minimal impact on near-term U.S. LNG exports and would not compromise energy security in Europe, which is already receiving sufficient LNG from the U.S..

- Only 14% of potential capacity additions over the next three years are affected by the pause. Meanwhile, U.S. LNG export capacity is poised to increase by more than half over the same time period, and Europe’s gas demand is forecast to decline.

In January 2024, the Biden Administration announced a pause on the Department of Energy (DOE) authorizing proposed LNG terminals to export gas to non-FTA countries, during which it will reassess whether such projects are in the public interest, the key criterion for authorization. The impacts of the pause on U.S. and global LNG development, including its effects on Europe, have at times been misunderstood or misrepresented, for instance, with the American Petroleum Institute calling the pause a “win for Russia” and “broken promise to U.S. allies.”

This briefing is intended to help contextualize the impacts of the pause on U.S. projects, which could curb an already overblown U.S. LNG buildout without compromising Europe’s energy security — crucially, if the pause holds or leads to new guidance discouraging future DOE authorization of these projects. GEM’s analyses draw on global LNG terminal data from the Global Gas Infrastructure Tracker and Sierra Club’s assessment of which projects may be impacted by the pause given permitting data in its US LNG Export Tracker.

The pause could curb the overbuild of U.S. LNG export projects

The U.S. was the world’s largest exporter of LNG in 2023, and with 336.9 mtpa of new LNG capacity in development — projects proposed or under construction — its pipeline of projects dwarfs that of every other gas exporting country. As GEM has previously written, the U.S. LNG buildout is not in the public interest — LNG exports raise domestic gas prices, lock in fossil fuel emissions abroad, and threaten Gulf Coast communities already burdened by oil and gas pollution.

Sierra Club’s tracking of project permits finds that twelve U.S. LNG projects in development are subject to the Biden Administration’s pause on LNG export authorizations to non-FTA countries (see Table 1). Because the list of FTA countries excludes much of the global LNG market, including virtually all of Europe and Asia, most export projects cannot be commercially viable without this authorization, and the pause effectively freezes these pending applications.

In total, paused projects amount to 88.9 mtpa of proposed export capacity, or one-quarter of all LNG export capacity in development in the United States and one-tenth of all such capacity globally. Two projects in Mexico are affected by the pause as well, Saguaro Energía LNG Terminal and New Fortress Altamira FLNG Terminal, which have 6.13 mtpa and 3.07 mtpa export capacity pending DOE approval, respectively.

A halt to these projects, if sustained, could have a significant impact on curbing global greenhouse gas emissions. The potential annual emissions associated with these projects could be as high as 381 megatonnes CO2 equivalent, on par with that of almost 100 coal plants. Stopping the development of these projects would be in line with the International Energy Agency’s net zero pathway, under which global LNG exports should peak by the middle of the decade.

The pause does not harm Europe’s energy security

The LNG pause would have a minimal impact on U.S. LNG exports in the near-term, despite oil and gas industry claims that it would compromise Europe’s energy security. According to GEM and Sierra Club data, just 14% of potential capacity additions within the next three years (2024 to 2026), totaling 17.2 mtpa, are impacted by the pause. The U.S. is already surpassing its LNG commitments to Europe, and U.S. export capacity is poised to increase more than 50% over the next three years from projects unaffected by the pause that are in construction or have reached final investment decisions (FIDs).

Europe, meanwhile, has emerged from its gas crisis and is expected to need less U.S. LNG in the coming years. The Institute for Energy Economics and Financial Analysis (IEEFA) forecasts that EU gas demand could fall 16% by 2030 and that “the continent’s LNG demand [will] peak in 2025 — far earlier than U.S. export projects affected by the pause would enter the market.” Declining gas demand is driven by Europe’s accelerating energy transition, including improved energy efficiency, demand management, and increased deployment of renewables. And given LNG’s vulnerability to price volatility and supply disruptions, these trends—not increased U.S. gas exports—will ultimately enhance Europe’s energy security.