Europe continues to pursue a costly and emissions-intensive buildout of gas import infrastructure capacity as if the region were on crisis footing, finds a new report from Global Energy Monitor (GEM).

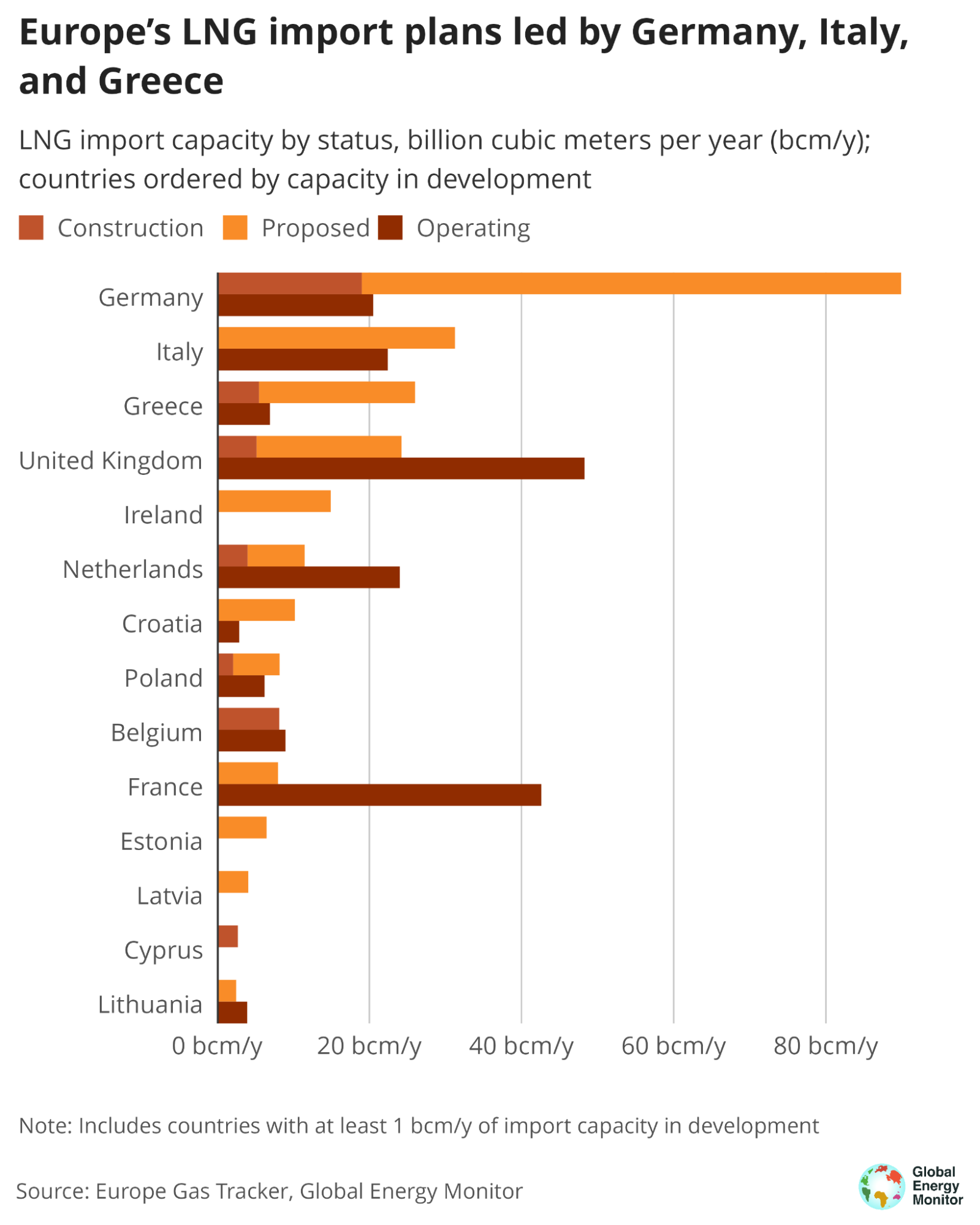

According to data in the Europe Gas Tracker, European countries are developing 248.7 billion cubic meters per year (bcm/y) in new LNG import capacity and 16,491 kilometers (km) in new gas transmission pipelines, which includes cross-border pipelines capable of importing a further 46 bcm/y of gas into Europe.

In the last year, the slate of new projects in development has grown by 9% for LNG import capacity and 18% for gas pipelines length.

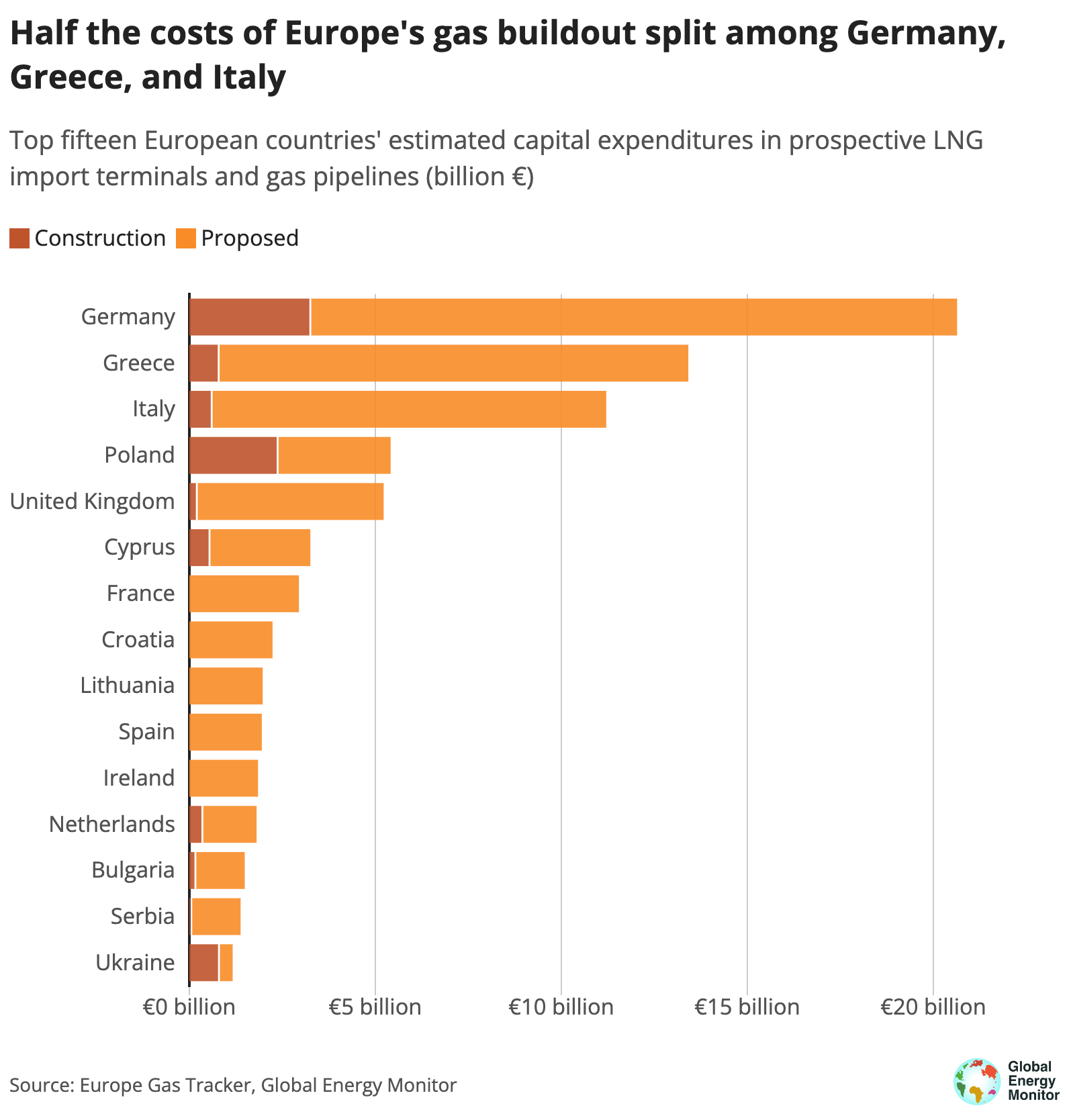

GEM estimates that the total capital expenditure in new European gas infrastructure could be €44.4 billion for LNG terminals and €39.7 billion for gas pipelines, for a total of €84.1 billion. Of this amount, projects already in construction total €10 billion.

Germany, Italy, and Greece, which are developing the most gas infrastructure in Europe, are together responsible for half of these plans (€45.3 billion).

The planned gas buildout is at odds with the European Union’s (EU) emissions goals. The EU’s Fit for 55 plan aims to reduce emissions by 55% by 2030, and in February, the European Commission called for an additional goal of reducing emissions by 90% by 2040.

GEM estimates that the LNG terminals and gas pipelines already in construction in Europe, if fully used, could result in an additional 195 megatonnes CO2 equivalent (CO2e), on par with the annual emissions of 50 coal plants. Including proposed projects, the additional annual emissions could grow six-fold to 1.1 gigatonnes CO2e, equivalent to that of nearly 300 coal plants, or a quarter of Europe’s emissions in 2020.

Although Europe’s LNG plans have advanced quickly, several high-profile project setbacks in 2023 could indicate waning enthusiasm for LNG. Import projects in Ireland, Latvia, and Poland totaling 16.8 bcm/y faced environmental objections or lost support from their backers, casting doubt on their futures. In total, 17.6 bcm/y of LNG import capacity in development are shelved and at least 60.6 bcm/y are delayed.

Robert Rozansky, Project Manager for the Europe Gas Tracker, said, “Europe is in a far different, and more secure, position today than at the start of its gas crisis. It is on track to eliminate Russian gas imports, overall gas demand is on the decline, and generation from renewables has reached new heights. Doubling down on new gas projects now would be completely out of step with Europe’s energy transition.”

Contact

Robert Rozansky, Project Manager, Global LNG Analyst, Global Energy Monitor

Email: [email protected]

About Global Energy Monitor

Global Energy Monitor (GEM) develops and shares information in support of the worldwide movement for clean energy. By studying the evolving international energy landscape, and creating databases, reports, and interactive tools that enhance understanding, GEM seeks to build an open guide to the world’s energy system.