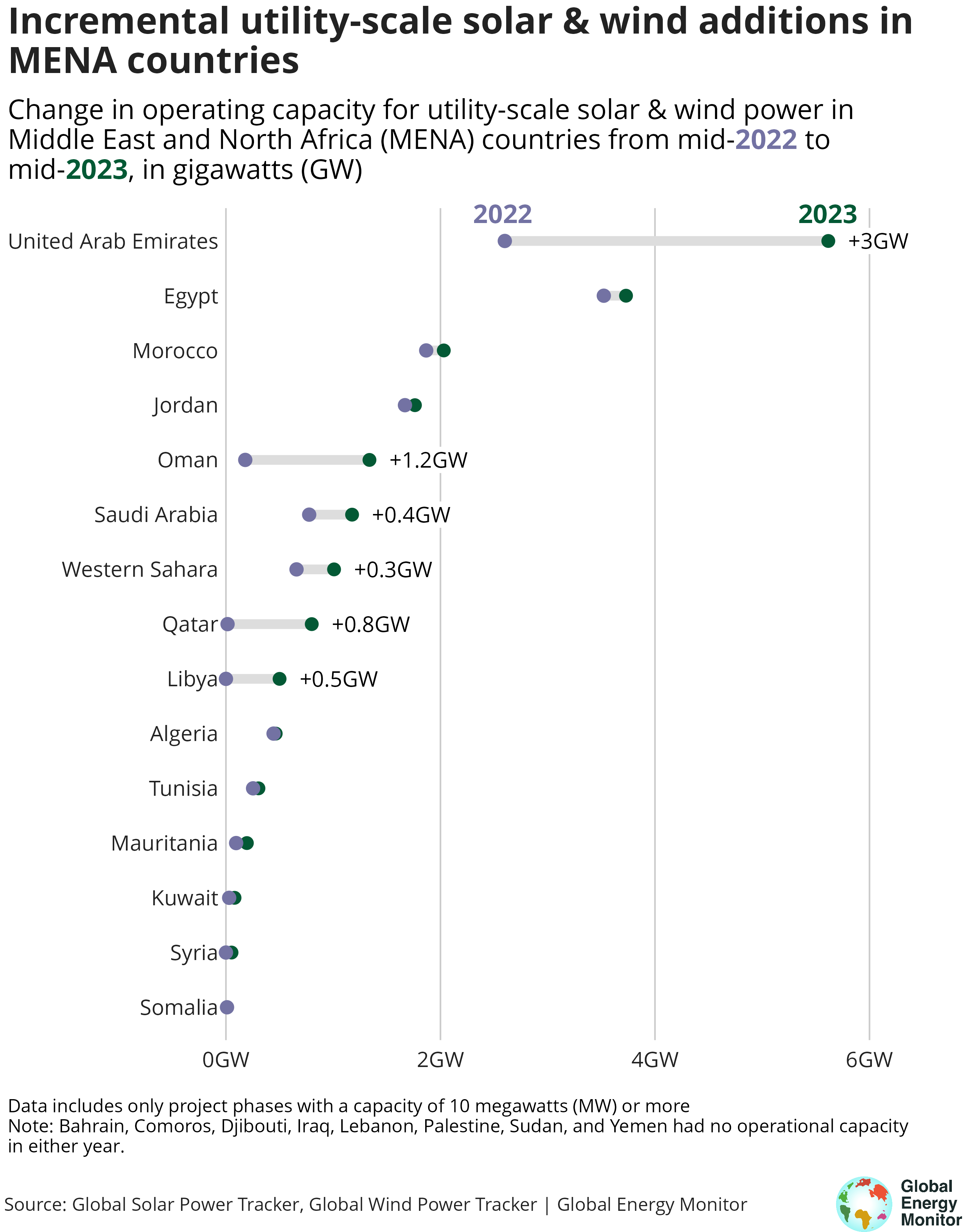

Arabic-speaking nations of the Middle East and North Africa (MENA) increased renewable capacity by 57% to 19 GW and are expected to increase by half again by 2024, but the region still needs twenty times that amount of renewables to replace existing gas-fired generation, finds a new report from Global Energy Monitor.

While a step forward for the heartland of fossil fuels, the renewables capacity added in the last year is relatively unambitious compared to MENA’s peers and dwarfed by the outsized role of oil and gas in the region.

Four times more renewables (32 GW) were brought online during that same period in South America, a region with a similar population size and gross domestic product, with Brazil alone adding over 14 GW of large utility-scale solar and wind.

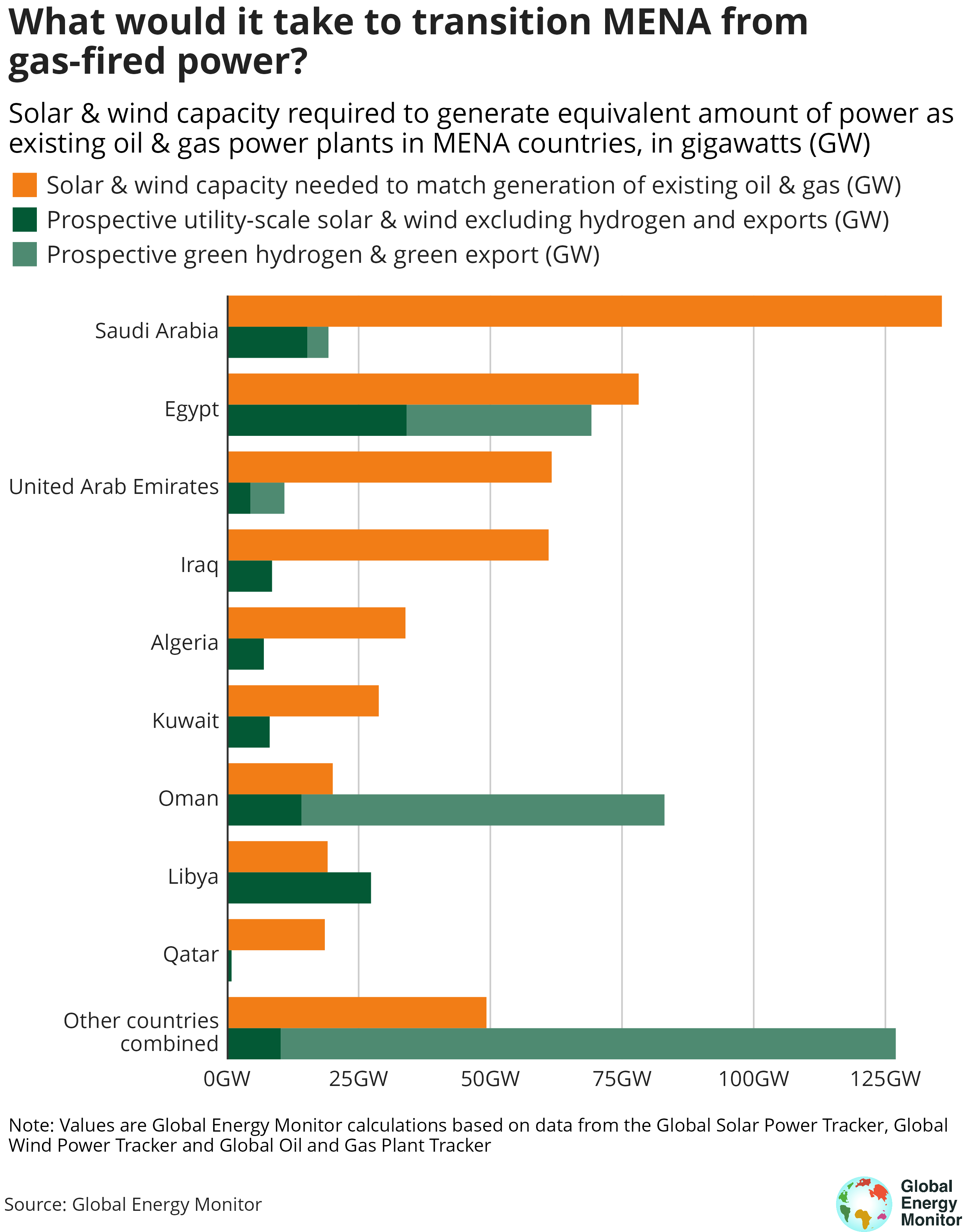

The incremental progress on renewables is all the more concerning given that MENA needs roughly 500 GW of solar and wind capacity to replace the electricity generation from the 343 GW of gas and oil power plants in the region.

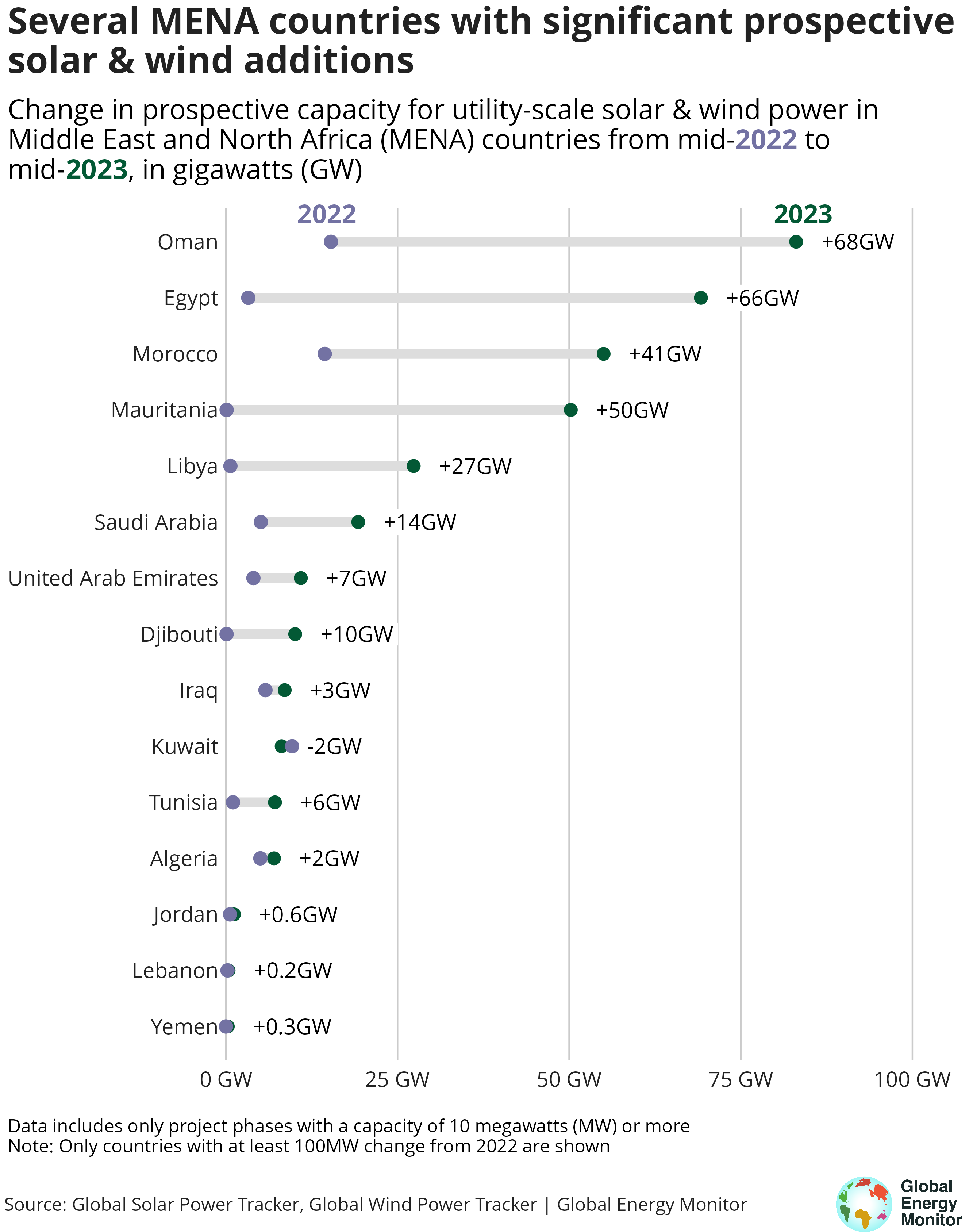

The report does show that all but two of the 23 nation-states in the MENA region have increased their plans for wind and solar power in the past year, with eight countries having at least three times more prospective capacity – projects that are either announced, in pre-construction, or under construction – than 12 months ago.

The region’s prospective capacity increased to 361 GW, a rise of 292 GW in the last year -more than the total prospective capacity in the U.S. and Canada combined.

Among all the prospective utility-scale solar and wind projects, just 6% (23 GW) are under construction.

Forty-seven percent (171 GW) are in pre-construction, meaning these projects have demonstrated either financing, government permitting, land rights, or formal power purchase or offtake agreements. The remaining 46% of prospective projects have just been announced.

More than half (60%) of this prospective capacity is earmarked for green hydrogen production or direct export. These hydrogen projects are massive — averaging 2.6 GW per phase (14 times the global average) — and have distant estimated start years.

Green hydrogen may offer a means for economic diversification for these oil and gas-dependent nations, but carries higher risk and will not contribute to decarbonizing local electricity usage.

Last year’s wind and solar additions are a step in the right direction for the region but still light years from dethroning oil and gas. The trouble is that the region’s path to a green economy relies overwhelmingly on hydrogen exports, which is an unproven technology that is not being designed to address energy access nor decarbonization at home.

Kasandra O'Malia, Project Manager for the Global Solar Power Tracker at Global Energy Monitor