Key points

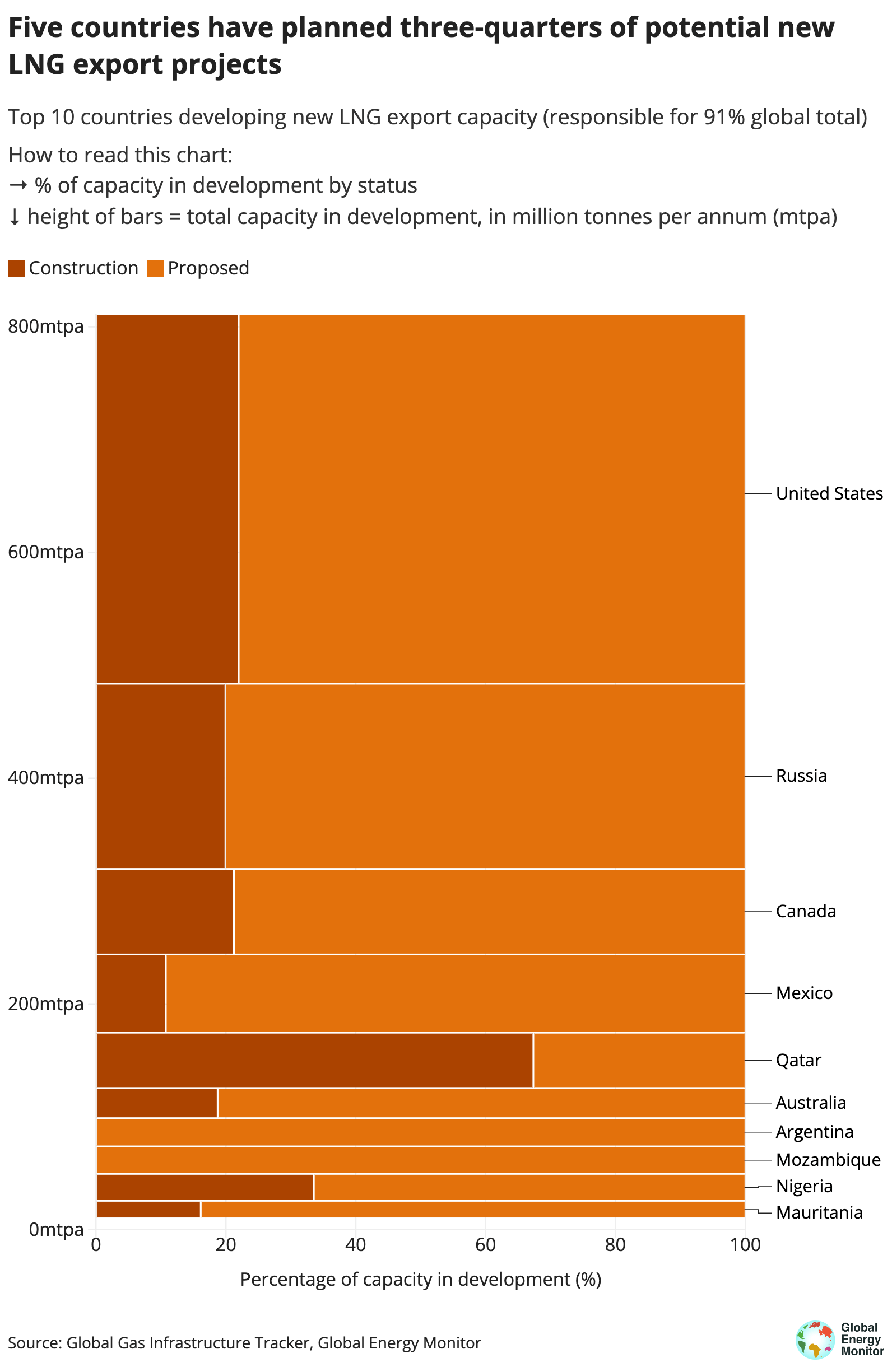

- Liquified natural gas (LNG) projects in development — those proposed or under construction — total 917 million tons per annum (mtpa) of new export capacity and 705 mtpa of new import capacity, representing an 18% and 4% year-on-year increase, respectively, at an estimated US$1 trillion in investment.

- Of this total, construction continues on 193 mtpa in export capacity and 203 mtpa in import capacity, which when brought online will boost global capacity 41% and 19%, respectively.

- Half of all export projects are under construction in the United States and Qatar.

Global LNG project developments spurred on by Russia's invasion of Ukraine materialized this year, as the U.S. and Qatar solidified their positions as top developers of export capacity, whilst Asian and European countries scrambled for new import capacity, according to a report from Global Energy Monitor.

According to data in the Global Gas Infrastructure Tracker, the leading countries developing new export terminals are the U.S. (336.9 mtpa), Russia (164.1 mtpa), Canada (75.8 mtpa), Mexico (69.3 mtpa), and Qatar (49 mtpa).

While relatively little new LNG export capacity has come online in recent years, a wave of new projects — half of which are under construction in the United States and Qatar, totalling 74 mtpa and 33 mpta, respectively — could saturate the global LNG market, increasing competition among exporters and rendering some projects unprofitable. The ensuing supply glut could leave governments and investors with costly stranded assets.

New import capacity is dominated by Asia (454 mtpa) and Europe (183 mtpa), with China (267.9 mtpa), India (75.2 mtpa), and Germany (65.4 mtpa) having the most capacity in development.

However, LNG demand in Europe could prove short-lived as the continent pursues its decarbonization agenda, and the price sensitivity of many Asian importers has called into question LNG demand growth forecasts.

Building new LNG projects when fossil demand is expected to peak this decade is a risky proposition for investors and governments alike. If even a fraction of these projects go ahead it would threaten to further delay the energy transition during a critical period.

Robert Rozansky, Global LNG Analyst at Global Energy Monitor