China already has enough lower-emissions steel capacity to meet its 2025 production targets and could cut emissions from the sector by as much as 11%, provided the country continues to add lower-emissions capacity and maximize its use, finds a new report from Global Energy Monitor.

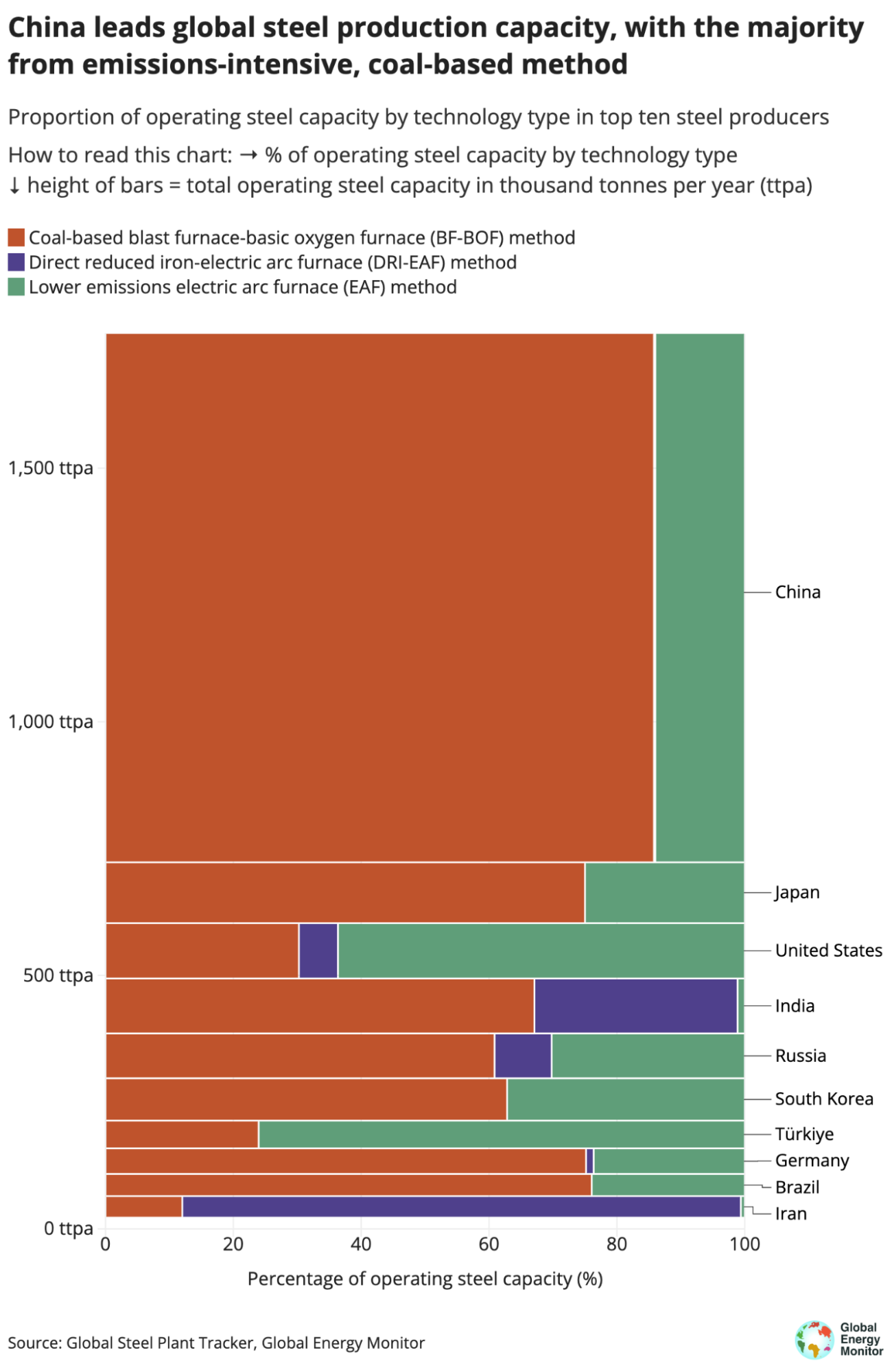

Data in the Global Steel Plant Tracker show that China has 151 million tonnes per annum (mtpa) of electric arc furnace (EAF) capacity operating as of January 2024. The remaining 913 mtpa is emissions-intensive, coal-based capacity.

In 2022, China’s Ministry of Industry and Information Technology (MIIT) set a target to achieve at least 15% crude steel production using EAF capacity by 2025, which was walked back from an initial target of 20%.

By 2025, China’s crude steel demand is projected to hit 910 mtpa, meaning that the country will need to produce 143 mtpa with EAF technology — less than the capacity currently installed — to achieve the 15% EAF production target.

If China were to hit the 20% EAF production target by 2025, the country would need to produce 190 mtpa using EAF technology, requiring at least another 39 mtpa of EAF capacity to be added and operated by the industry by 2025.

China currently has 48 mtpa EAF capacity under development, but 21 mtpa set to close, so the industry is set to add approximately 27 mtpa under current development and closure plans.

Reaching 20% EAF production by 2025 would reduce the industry’s emissions by a total of 217 mtpa CO2, equivalent to an 11% reduction compared to 2022 emissions. That is roughly the same as taking 47 million passenger vehicles off the road.

Installing enough capacity to reach the 15–20% EAF production targets only achieves these emissions reductions if China operates its EAFs at similarly high capacity utilization rates to those of its coal-based capacity.

To date the main factors contributing to China’s low capacity utilization rates for EAF have been limited scrap and electricity supplies. However, China’s scrap supply is projected to grow rapidly in the next decade, and China has invested significantly to expand its grid, bringing relief to these pinch points.

These shifts have made EAF production economically competitive with coal-based capacity, in addition to being environmentally favorable.

China’s current plans for the steel industry do not back up President Xi Jinping’s latest calls for green and low-carbon industries. With modest adjustments, China can take a crucial step towards decarbonizing the global steel sector.

Caitlin Swalec, Program Director, Heavy Industry