Key points

- Approximately 69,700 kilometers (km) of gas transmission pipelines are under construction globally, an 18% increase over the previous year, at a cost of US$193.9 billion

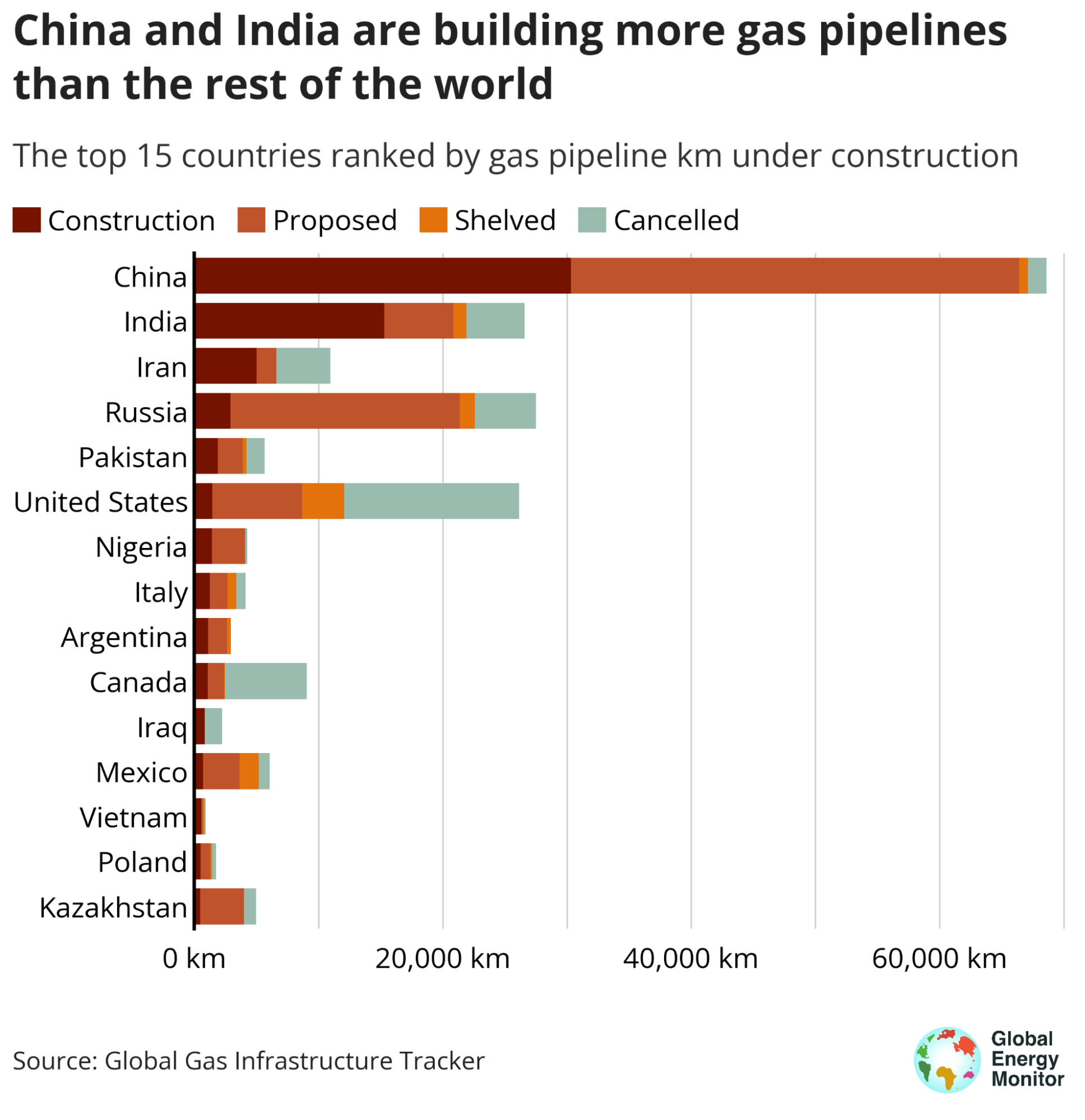

- Asia leads the world in pipeline construction, accounting for 82% at an estimated cost of US$117.2 billion, with China and India responsible for 65% of global construction

- Globally 228,700 km of gas transmission pipelines are in development — counting projects that are in construction or have been proposed — at a total price tag of US$723 billion

The length of gas transmission pipelines currently under construction is enough to circle the Earth one-and-a-half times, representing an 18% increase over last year, finds new research from Global Energy Monitor.

Data in the Global Gas Infrastructure Tracker show that approximately 69,700 km of gas transmission pipelines are under construction globally, at a cost of US$193.9 billion. When counting the number of projects that have been announced, a total of 228,700 km of gas transmission pipelines are in development worldwide, at a total price tag of US$723 billion.

Much of the buildout is in Asia, with 14 of the 15 longest pipeline projects under construction located there. Outside of the region, the U.S. is another top builder of gas pipelines, aiming to bolster export capacity out of the Permian Basin and Haynesville Shale in order to capitalize on present and future European and Asian import markets. Australia, another major gas exporter, is taking a similar approach.

South America is also poised for significant gas infrastructure growth in the coming years after inaugurating a pipeline carrying gas from the Vaca Muerta formation, the second-largest shale gas reserve in the world, in July 2023.

Asia is gambling on more fossil fuels and encouraging other major economies to do the same. Across the region the price of renewables has come down, gas emissions are considered to be worse than coal when transport is factored in, and peak gas demand has been predicted by the end of this decade. This gas infrastructure is risky and thoughtless.

Baird Langenbrunner, Project Manager for the Global Gas Infrastructure Tracker at Global Energy Monitor