Coal has been built out excessively in Indonesia over the last decade. The country’s coal fleet is very young, with three-quarters of operating coal capacity built since 2005. For grid power, Indonesia is experiencing overcapacity, and multiple coal-fired power plants (CFPPs) have finished construction in the last year but have remained unused.

A new report by the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM) finds that captive coal power, referring to power stations that are operated and utilised off-grid by industrial actors, has exploded across the island nation with nearly eight times more captive capacity operating in 2023 than in 2013.

Key findings:

- Nearly 25% of operating coal capacity in Indonesia is for captive use, but the government's efforts to transition away from coal are currently limited to the power sector.

- Captive power capacity has increased nearly eightfold from 2013 to 2023, from 1.4 GW to 10.8 GW operating.

- 50% of proposed coal capacity additions (announced, pre-permit and shelved) as of July 2023 is for captive use. 14.4 GW of captive coal capacity is proposed or in construction.

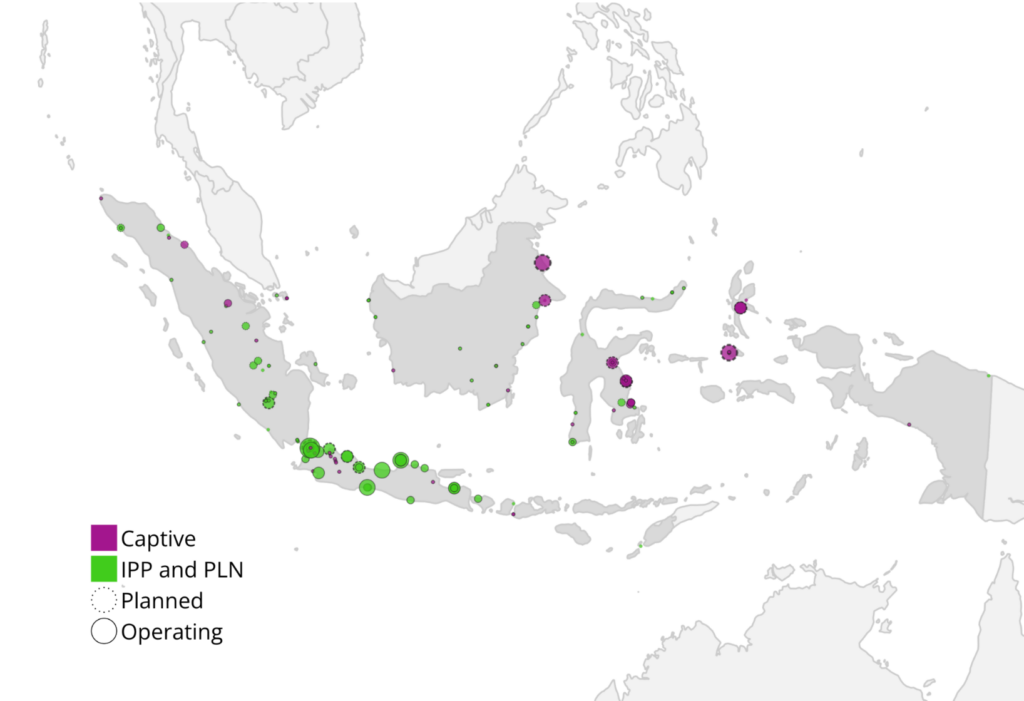

- Indonesia is a leading supplier of the critical metals needed for a renewable energy transition, but many operating and planned smelters are operated using coal power. The national industrial development plan for 2015-2035 considers metal processing to be "added value to natural resources", and developing coal plants is allowed when they will increase the "added value of natural resources". Smelters are currently located in 13 provinces.

- Coal capacity additions have been outpacing renewables additions, despite Indonesia's stated goal of peaking emissions by 2030 through the acceleration of renewable energy deployment.

- Future emissions from captive coal plants are a major threat that must be considered within the planned use of the USD 20 billion JETP funding. As the launch of the JETP investment plan has been delayed, Indonesia and international partners must negotiate commitments to clear, focused and ambitious targets.

Captive CFPPs sit at the heart of a clean energy transition contradiction. According to Global Energy Monitor’s latest Global Coal Plant Tracker update, 8.2 gigawatts (GW) of the 10.8 GW capacity operating as captive CFPPs in Indonesia are for the metal processing industry. These metals, including nickel, aluminium, and iron, are necessary products for the renewable energy transition. Yet, they are processed using power from coal.

Indonesia’s existing climate commitments effectively leave a loophole for the continued development of captive CFPPs. Over half (50.1%) of the country’s remaining proposed coal capacity additions are for captive use, but the government’s efforts to decarbonize the energy sector have thus far been limited to grid power.

In the meantime, Indonesia’s Just Energy Transition Partnership (JETP) investment roadmap has been officially delayed. The USD 20 billion agreement between Indonesia and the Group of 20, announced in November 2022, is the crucial opportunity Indonesia needs to phase out coal power and build out renewable energy capacity. Targets for peak and net-zero emissions have been brought forward to 2030 and 2050, respectively. Financial, political and infrastructural barriers have so far prevented these goals from being translated into actionable plans. The government must now prioritise these goals and utilise the opportunity for international support to both develop the critical metal industry and accelerate the phaseout of coal power in parallel.

The lack of transparency and ongoing challenge of even determining the true scale of the captive coal power used by industry in Indonesia risks sabotaging the country’s energy transition. Rather than let JETP planning falter, the government ought to fast-track the development of the critical metal industry and coal power phaseout with the help of international partners.

Lucy Hummer, Researcher at Global Energy Monitor