Boom and Bust is an annual survey of the global coal fleet by Global Energy Monitor and partners. The report analyzes key trends in coal power capacity and tracks various stages of capacity development including planned retirements. This provides key insights into the status of the global phaseout of coal power and evaluates progress towards the world’s climate targets and commitments.

The data comes from GEM’s Global Coal Plant Tracker, an online database updated biannually that identifies and maps every known coal-fired generating unit and every new unit proposed since January 1, 2010 (30 MW and larger).

Global Energy Monitor's data serves as a vital international reference point used by organizations including the Intergovernmental Panel on Climate Change , International Energy Agency and the United Nations as well as global media outlets.

Global operating coal capacity grew by 2% in 2023, with China driving two- thirds of new additions, and a small uptick was seen for the first time since 2019 in the rest of the world, according to Global Energy Monitor's annual survey of the global coal fleet.

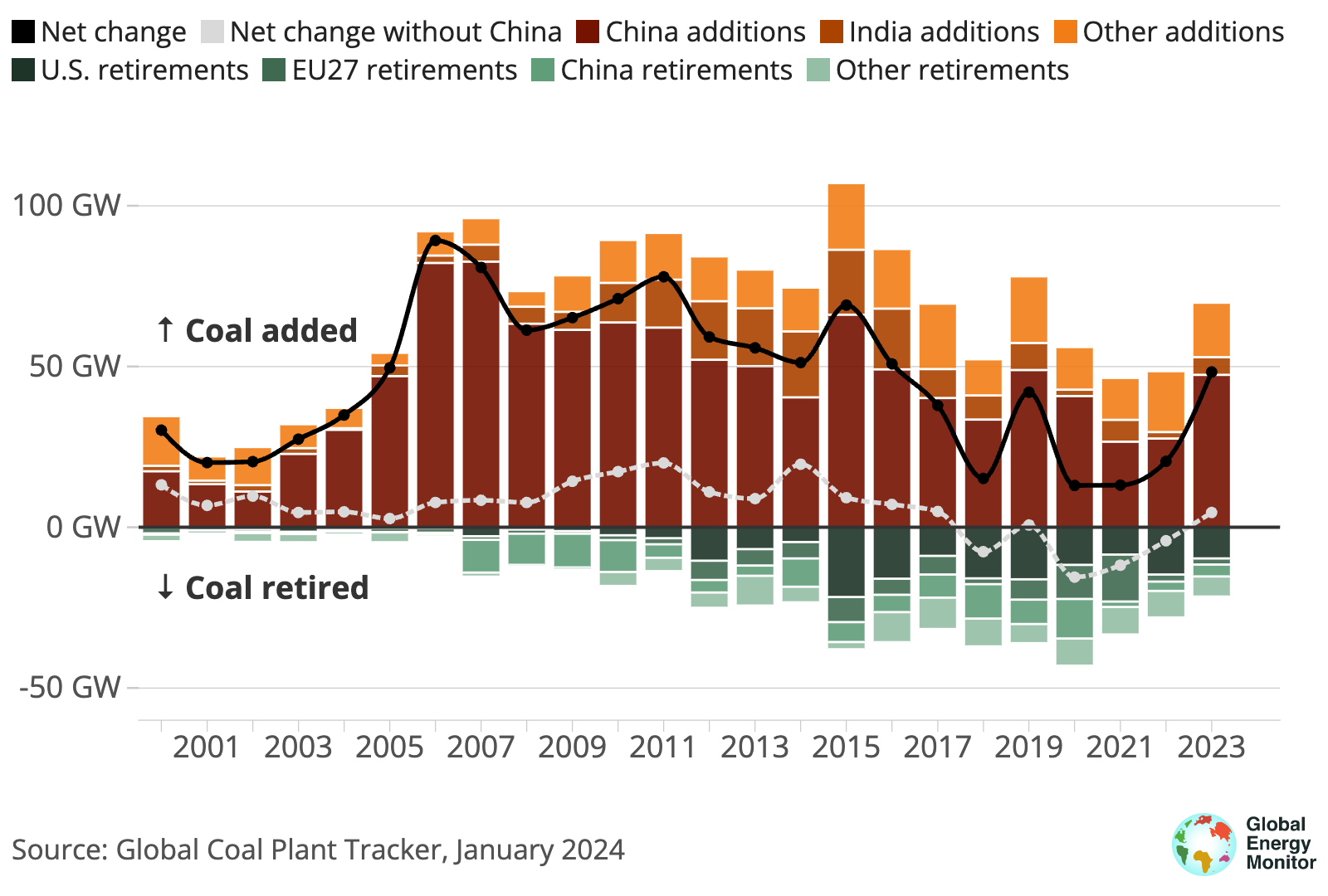

Data in the Global Coal Plant Tracker show that 69.5 GW of coal power capacity was commissioned while 21.1 GW was retired in 2023, resulting in a net annual increase of 48.4 GW for the year and a global total capacity of 2,130 GW. This is the highest net increase in operating coal capacity since 2016.

The global operating coal fleet grew further, including rise outside China for first time since 2019 as retirements slowed

Annual change in coal-fired power capacity, in gigawatts (GW)

A surge in new coal plants coming online in China drove this increase — 47.4 GW, or roughly two- thirds of global additions — coupled with new capacity in Indonesia, India, Vietnam, Japan, Bangladesh, Pakistan, South Korea, Greece, and Zimbabwe.

In total, 22.1 GW was commissioned and 17.4 GW was retired outside of China, resulting in a 4.7 GW net increase to the operating coal fleet.

Although new retirement plans and phaseout commitments continued to emerge, less coal capacity was retired in 2023 than in any other single year in more than a decade.

Lower retirements in the U.S. and Europe contributed to the coal capacity upswing. At 9.7 GW, the U.S. contributed nearly half of capacity retired in 2023, a drop from the 14.7 GW retired last year and its 21.7 GW record high in 2015.

European Union member states and the United Kingdom represented roughly a quarter of retirements, with the U.K. (3.1 GW), Italy (0.6 GW), and Poland (0.5 GW) leading the region’s retirements for the year.

But the accelerated growth in coal capacity may be short-lived, as low retirement rates in 2023 that contributed to coal’s rise are expected to pick up speed in the U.S. and Europe, offsetting the blip. Heightened capacity additions would also be tempered if China takes immediate action to ensure it meets its target of shutting down 30 gigawatts (GW) of coal capacity by 2025.

Coal’s fortunes this year are an anomaly, as all signs point to reversing course from this accelerated expansion. But countries that have coal plants to retire need to do so more quickly, and countries that have plans for new coal plants must make sure these are never built. Otherwise we can forget about meeting our goals in the Paris Agreement and reaping the benefits that a swift transition to clean energy will bring.

Flora Champenois, GEM Coal Program Director

The trajectory the global coal fleet takes from here depends to an extent on new construction starts — one of the key indicators of growth in the sector — which declined outside of China for the second year in a row and hit a record annual low since data collection began in 2015. In China, the exact opposite happened, with new construction starts increasing for the fourth year in a row and hitting an eight-year high.

The report shows that construction started on less than 4 GW of new projects outside China in 2023, well below the 16 GW annual average between 2015 and 2022 for the same set of countries. Only seven countries, excluding China, appeared to start construction on new coal units last year: one plant each in India, Laos, Nigeria, Pakistan, and Russia, as well as three plants in Indonesia.

Moreover, no coal plant construction has started in Latin America since 2016, and no coal plant construction has started for member countries within the OECD, Europe, or the Middle East since 2019. In Nigeria, the start of foundation work at the mine-mouth Ugboba power station in 2023 was the first known construction start in Africa since 2019.

Gap between China and rest of world widens further on key coal indicators

But China’s continued coal construction surge in 2023 stands in stark contrast to these global trends and offsets gains from dwindling coal capacity elsewhere.

China’s 70.2 GW of new construction starts in 2023 represents 19 times more than the rest of the world’s 3.7 GW and is the country’s highest annual capacity breaking ground since 2015.

The new construction starts in China were also nearly quadruple what they were in 2019 when it hit a nine-year annual low of entirely new builds.

In 2023, coal capacity in development globally — including projects in the announced, pre-permit, permitted, and in construction phases — increased from 550.6 GW to 578.2 GW, a 5% increase driven by China.

Progress towards the last coal plant starting construction continues

The global coal landscape has been in transformation for almost a decade, marked by a collapse in the amount of planned coal power plants following the adoption of the Paris Agreement in late 2015. There has been a 68% reduction in global pre-construction capacity since then, and new construction starts are at their lowest outside of China since data collection began.

The past year has seen the OECD and EU continue to progress in their journey away from coal. The operating coal fleet and the pre-construction capacity in the OECD/EU have both declined in 2023, continuing the downward trend since the Paris Agreement.

The total pre-construction capacity is now at 7.1 GW, the lowest level since data collection began for the region. Only four countries, Australia, Japan, Türkiye, and the United States, are still considering coal projects. Türkiye has had seven planned projects put on hold in 2023, but it still accounts for 68% of the planned capacity in the OECD/EU and remains the only OECD country in the global top ten.

Climate concerns, unfavorable economics, and public opposition continue to close the door on many coal plant proposals — and close actual doors at some coal plants. In 2023, twelve new countries committed to No New Coal by becoming members of the Powering Past Coal Alliance (PPCA).

As of January 2024, 101 countries have either formally committed to No New Coal or have abandoned any coal plans they had in the last decade. This shows a growing awareness of the need to shift to cleaner and more sustainable energy sources, even in places where coal has previously been a major part of the energy mix.

Almost all countries have reduced their announced, pre-permit, permitted, and construction coal capacity since 2015. Only six countries have increased coal power capacity under development since 2015, and the biggest increase did not exceed 3 GW. In contrast, coal power capacity under development in China, India, and Türkiye decreased by more than 300 GW, 200 GW, and 50 GW, respectively, between 2015 and 2023.

Which countries are still planning more coal?

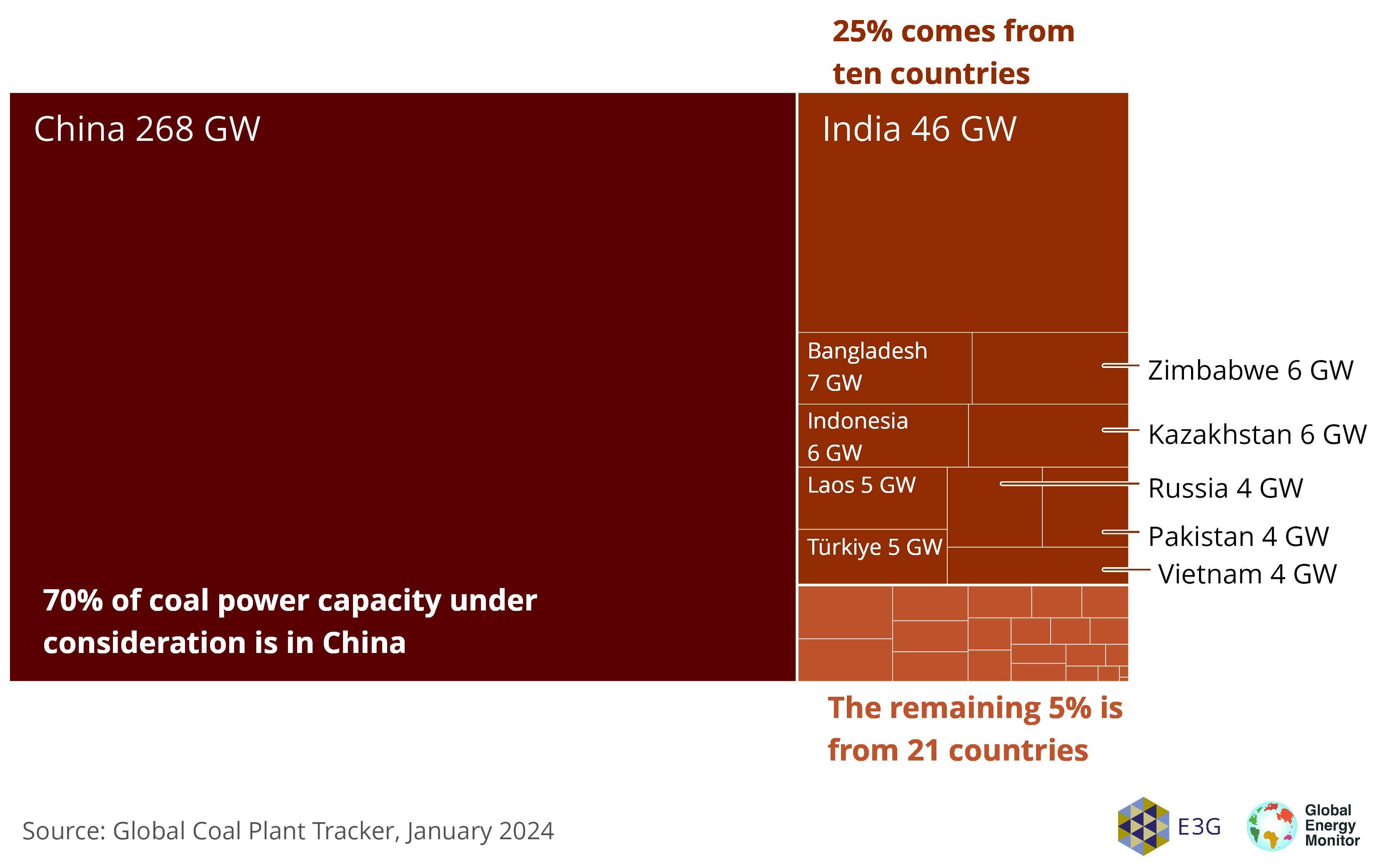

China and India, the two largest coal consumers globally, continue to substantially influence the global coal narrative, collectively accounting for 82% of the total pre-construction capacity (announced, pre-permit, and permitted) worldwide.

Outside of China and India, pre-construction capacity is currently at its lowest since data collection began, but growth in these two countries resulted in the total global capacity in pre-construction increasing by 6% in 2023.

This significant concentration highlights China’s increasing dominance in coal capacity development.

China and ten other countries account for 95% of coal power capacity under consideration

Coal-fired power capacity in pre-construction stages (announced, pre-permit and permitted)

Along with China, ten other countries — India, Bangladesh, Zimbabwe, Indonesia, Kazakhstan, Laos, Türkiye, Russia, Pakistan, and Vietnam — collectively account for 95% of this capacity. India accounts for nearly half of the planned capacity within these ten countries.

The remaining 5% is distributed among 21 countries, eleven of which have only one project and are on the brink of achieving the “no new coal” milestone.

Thankfully, various countries are making clear that shutting coal down is possible, and most of the world is closing in on “no new coal.” Of 82 countries with coal power, 47 have reduced or kept operating capacity flat since the 2015 Paris Agreement.

Austria, Belgium, Sweden, Portugal, Peru, and the United Arab Emirates have retired or converted their last operating coal plants, while Slovakia, the U.K., and potentially others are projected to join them in 2024.

But despite countries where coal power capacity decreased or stayed flat outnumbering those that have increased it, nearly twice as much coal power capacity has been added globally than retired since Paris.

The number of new coal power plants coming online has outpaced plant closures over the past eight years, with the world’s coal power capacity actually rising 11% since 2015.

The majority of the increase has come from China, where overall capacity is 260 GW higher than it was in 2015. Other countries like India, Indonesia, Vietnam, South Korea and Japan have also recorded notable increases to their operating coal capacity.

Most coal capacity still lacks a coal closure commitment

In order to meet the 2015 Paris Agreement goals and put the world on a pathway to no more than 1.5°C of global warming, reducing the use of coal for power generation is the single most important source of emissions reductions.

To align with that goal, modeling by the International Energy Agency and others finds that OECD countries should eliminate coal power by 2030 and the rest of the world by 2040.

Countries must ramp up phaseout commitments, as well as ensure announcements are translated into plant-by-plant retirement plans.

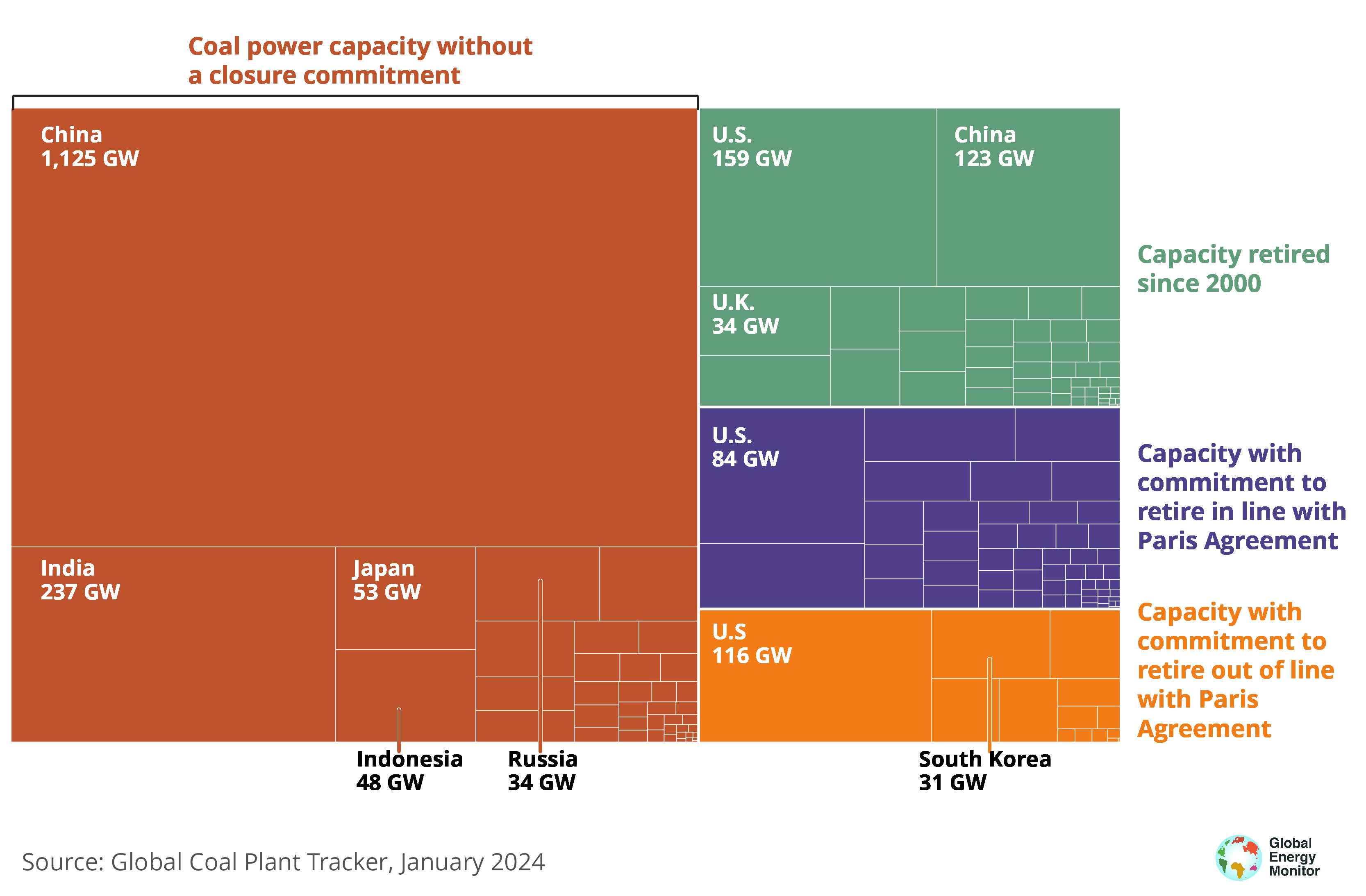

Just 15% (317 GW) of the global operating capacity has a commitment to retire in line with these commitments. Another 10% (210 GW) has a closure commitment that needs to be sped up to keep up with the world's climate goals.

And although the vast majority of operating global coal capacity is now captured by some type of national net zero or other pledge, 75% (1,626 GW) still lacks a coal closure commitment.

Most coal power capacity needs a closure commitment

Coal-fired power capacity by phaseout status, excluding net zero commitments

Phasing out operating coal power by 2040 would require an average of 126 GW of retirements per year for the next 17 years, the equivalent of about two coal plants per week. Accounting for coal plants under construction and in pre-construction (578 GW) would require even steeper cuts.

Boom and Bust Coal 2024 is a joint effort by Global Energy Monitor, Centre for Research on Energy and Clean Air (CREA), E3G, Reclaim Finance, Sierra Club, Solutions for Our Climate, Kiko Network, Climate Action Network (CAN) Europe, Bangladesh Working Group on External Debt (BWGED), Coastal Livelihood and Environmental Action Network (CLEAN), Waterkeepers Bangladesh, Dhoritri Rokhhay Amra (DHORA), Trend Asia, Alliance for Climate Justice and Clean Energy, Chile Sustentable, POLEN Transiciones Justas, Iniciativa Climática de México, and Arayara. Beyond Fossil Fuels also joined the Turkish version of the report.