Key points

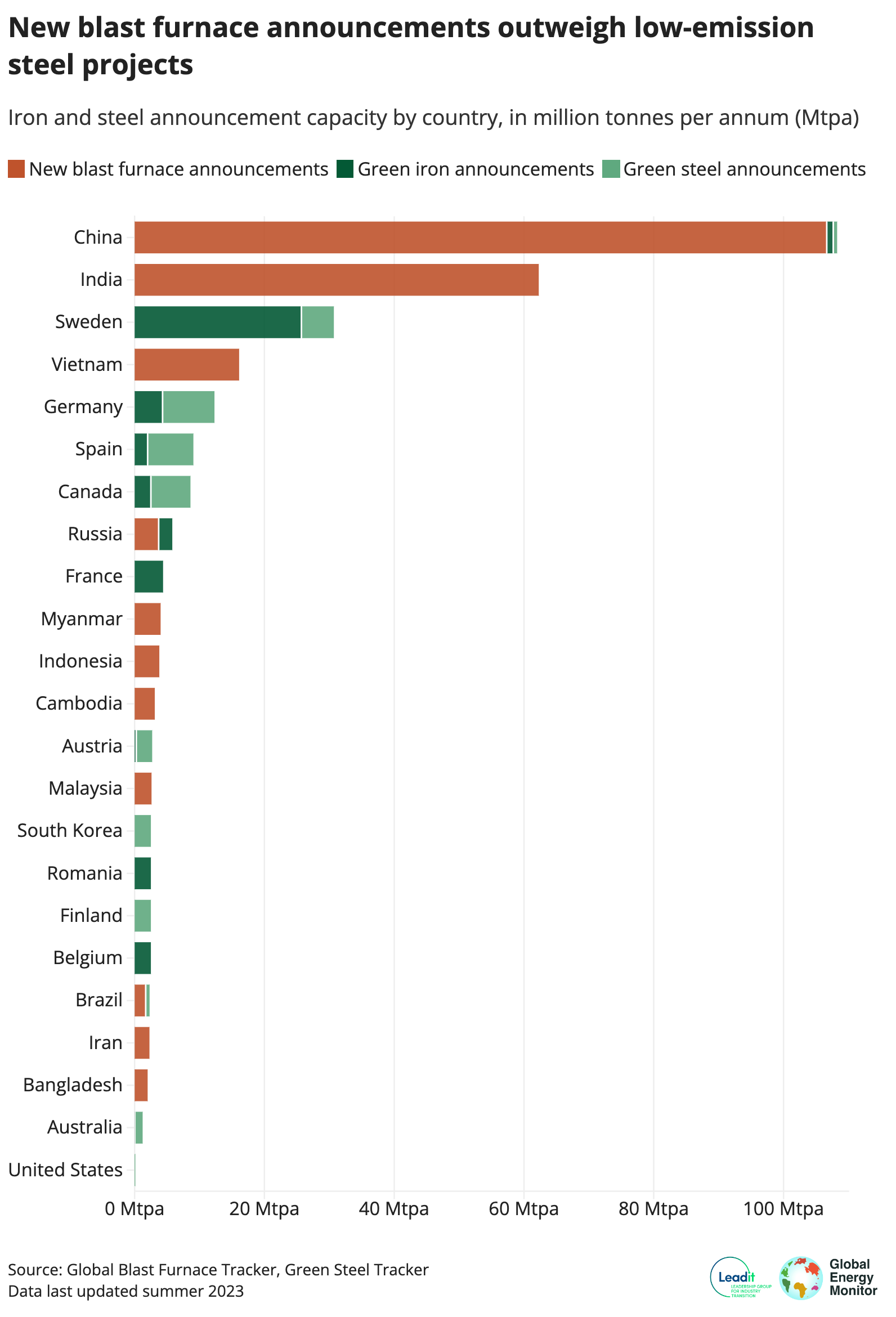

- New research shows that planned capacity for coal-based blast furnaces is 208.2 million tonnes per annum (Mtpa), two-and-a-half times the 83.6 Mtpa in planned primary green iron and steel capacity.

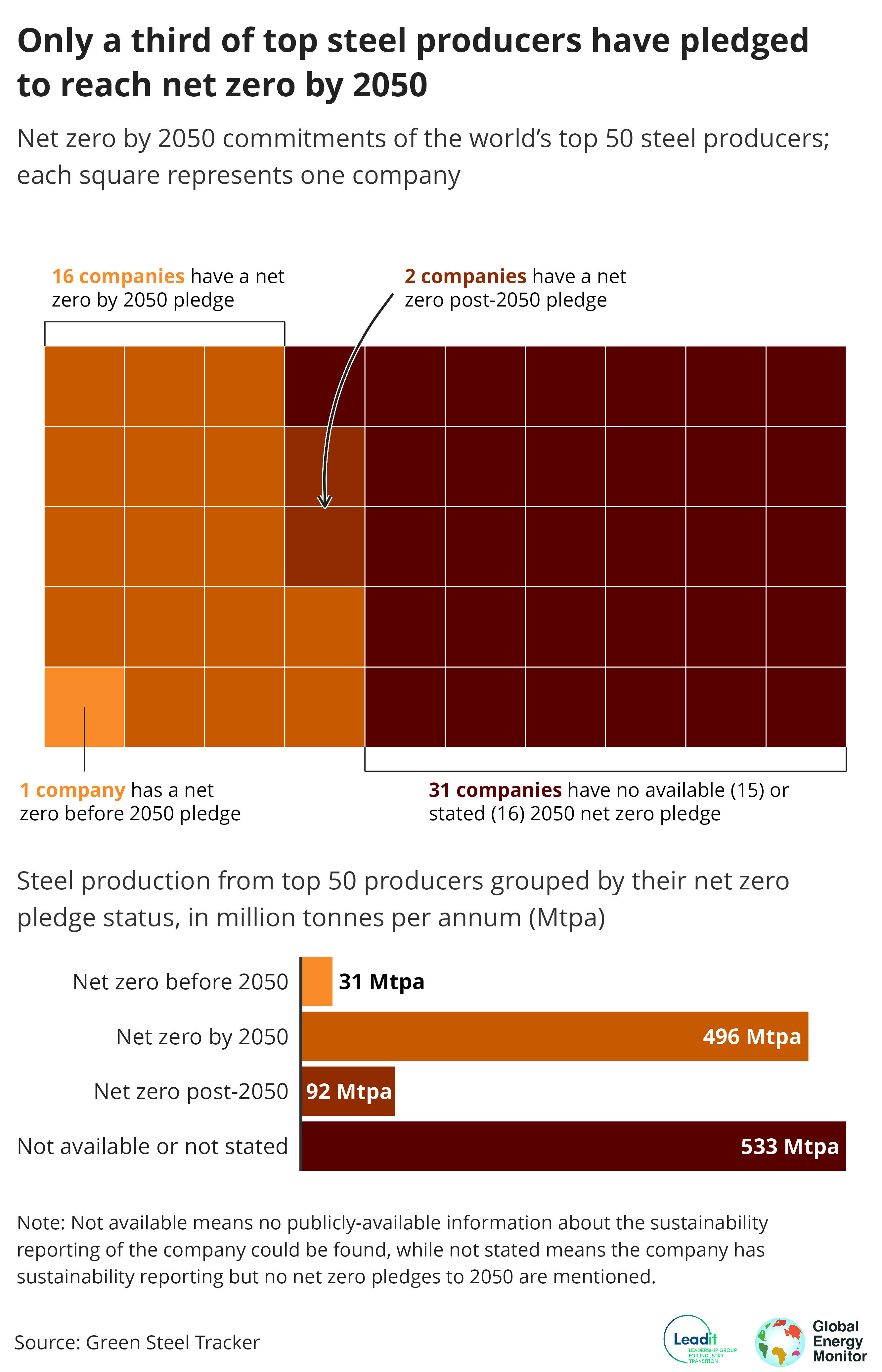

- Latest data show only a third of the world’s top 50 steel producers have set targets to reach net zero emissions by 2050, despite these 50 producers being responsible for more than 60% of the sector’s emissions.

New plans for coal-based steelmaking capacity are outpacing greener primary steel production methods with only a third of the world’s top 50 producers having announced targets to reach net zero by midcentury, despite the need to drastically reduce emissions in the sector, finds a new report from Global Energy Monitor and Stockholm Environment Institute’s Leadership Group for Industry Transition.

The report finds that planned coal-based blast furnace capacity worldwide totals 208.2 million tonnes per annum (Mtpa), two-and-a-half times greater than the 83.6 Mtpa in planned primary green iron and steel capacity. Investments in primary green iron and steel projects are growing, but mostly in developed markets and not fast enough to outpace emissions-intensive technologies.

The steel sector accounts for an estimated 7 to 9% of direct global greenhouse gas emissions, and the International Energy Agency has said that CO2 emissions from heavy industries need to drop 93% in order to reach net zero emissions by 2050.

Yet only 17 of the largest 50 steel producers have publicly committed to achieving net zero by mid-century, despite these 50 producers being responsible for more than 60% of the sector’s emissions. The 17 producers that have a 2050 net zero goal account for more than a quarter (527 Mtpa) of global steel production.

Data also show that only two of 50 producers have included Scope 3 emissions calculations in their net zero goals. Scope 3 emissions play a significant role in steelmaking and can account for well over 40% of overall emissions from the sector. Scope 3 emissions include those produced during material extraction, preparation and processing, transportation, as well as fuel and energy-related emissions not covered under Scope 1 or 2, including direct emissions from a company's own furnaces, vehicles, and chemical processes, as well as the purchase of electricity.

The biggest steel producers are also the biggest culprits in terms of emissions. They must swap out coal-based processes for cleaner ones. But it’s impossible to score if you don’t know where the goalposts are. Ambitious and transparent targets are critical.

Caitlin Swalec, Program Director for Heavy Industry at Global Energy Monitor

The gap in announced primary green steel projects between the Global North and South underscores the importance of global partnerships to improve the business case and mobilize financing for low-carbon steel investments in all countries, including developing and emerging markets set for significant growth in the steel sector. Creating a level global playing field is also essential to support companies to commit to tangible, time-bound emissions reductions.

Eileen Torres Morales, Analyst at Leadership Group for Industry Transition