Key points

- ASEAN countries have over 28 gigawatts (GW) of operating utility-scale solar and wind capacity, up 20% from 23 GW in the last year.

- Vietnam has the largest share of operating utility-scale solar and wind capacity in the region at 19 GW, followed by Thailand and the Philippines each with 3 GW.

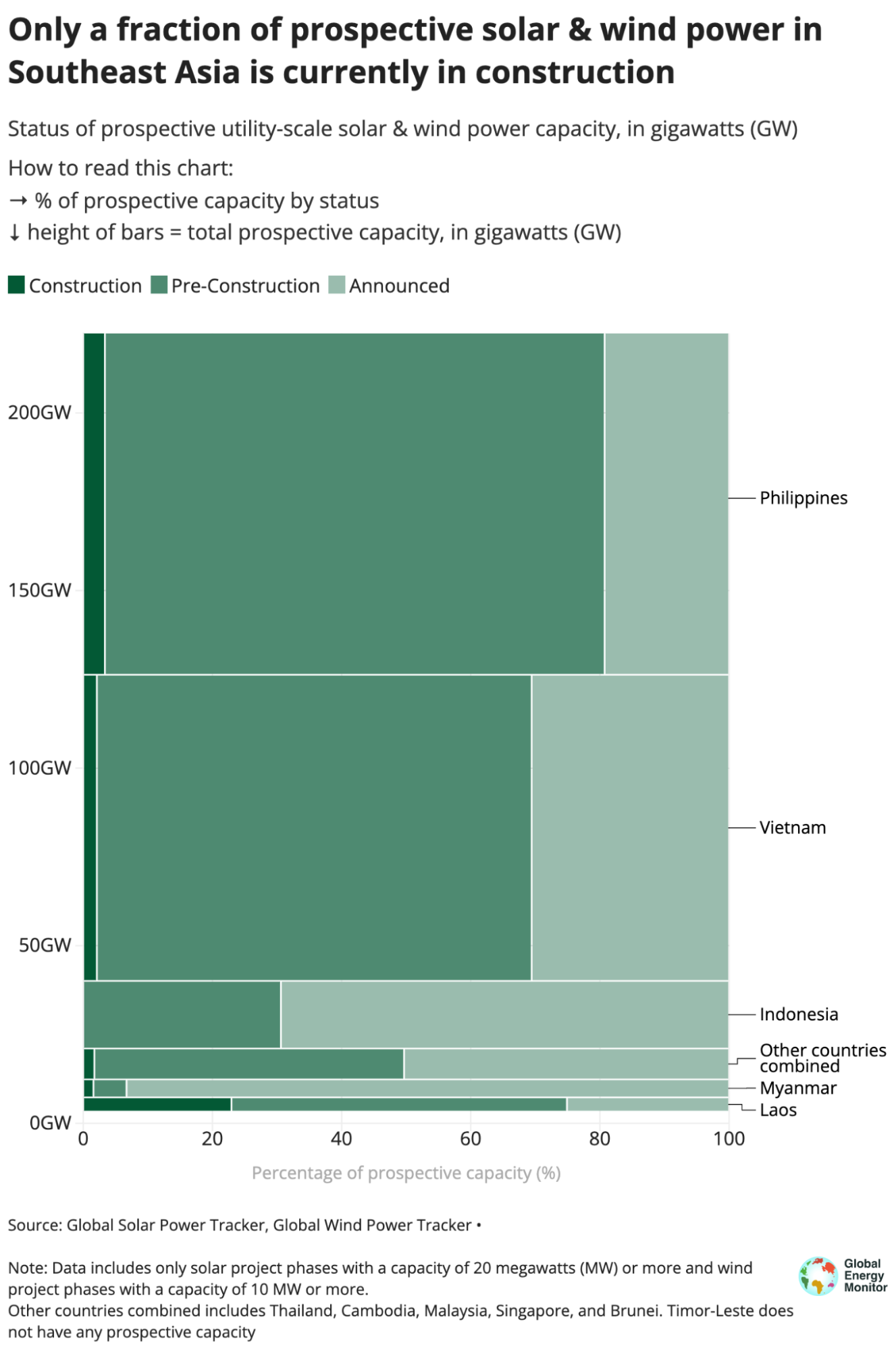

- While the region boasts a whopping 220 GW of prospective capacity –– projects that have been announced or are in the pre-construction and construction phases –– only a fraction of this capacity (6 GW, or 3% –one quarter of the global average) is currently under construction.

- The Philippines and Vietnam have 99 GW and 86 GW, respectively, of prospective utility-scale solar and wind power, which add up to 80% of the region’s total, and represent the eighth- and ninth-largest prospective capacity worldwide.

Utility-scale solar and wind capacity in the Association of Southeast Asian Nations (ASEAN) is up by a fifth since this time last year, and the region is on track to easily meet its upcoming renewables commitments ahead of schedule.

But lack of progress in breaking ground on new projects, coupled with a challenging regulatory environment for renewables and continued reliance on fossil fuels, poses an uphill path to a clean energy transition, finds a new report from Global Energy Monitor.

Data from the Global Solar and Wind Power Trackers show that ASEAN countries have grown their utility-scale solar and wind capacity 20% in the last year to over 28 GW.

Vietnam has the largest share of operating utility-scale solar and wind capacity in the region at 19 GW, followed by Thailand and the Philippines each with 3 GW. The Philippines and Vietnam have 99 GW and 86 GW, respectively, of prospective utility-scale solar and wind power, which add up to 80% of the region’s total, and represent the eighth- and ninth-largest prospective capacity among countries worldwide.

The ASEAN region also boasts almost five times more prospective offshore wind power (124 GW) than onshore, which amounts to nearly twice the current offshore operating capacity worldwide (69 GW).

Yet despite an impressive pipeline of prospective projects, only a fraction of this capacity is currently under construction (6 GW, or 3% — one quarter of the global average).

At the same time, with a goal of 35% installed renewables capacity by 2025, ASEAN countries only need to add an additional 10.7 GW of utility-scale projects on top of what is already in construction in order to meet this goal. With 23 GW set to become operational by 2025, the region is likely to far surpass this milestone.

Janna Smith, researcher with Global Energy Monitor and lead author of the report, said “The growth of renewables across the region is impressive, but so much more can be achieved. With the world now aiming to triple renewables capacity by 2030, governments need to make it easier to bring wind and solar power online. Switching to renewables now from coal and gas will save countries time and money on the path to a clean energy future.”

Contact

Janna Smith, Researcher, Global Energy Monitor

Email: [email protected]

Note: This release has been amended to reflect that fact that the Philippines and Vietnam have the eighth- and ninth-largest prospective utility-scale solar and wind power capacity worldwide.

About the Global Solar and Wind Power Trackers

The Global Solar Power Tracker is a worldwide dataset of utility-scale solar photovoltaic and solar thermal facilities. It includes solar farm phases with capacities of 20 megawatts (MW) or more (10 MW or more in Arabic-speaking countries) and medium utility-scale projects down to 1 MW globally. The Global Wind Power Tracker is a worldwide dataset of utility-scale, on and offshore wind facilities. It includes wind farm phases with capacities of 10 megawatts (MW) or more.