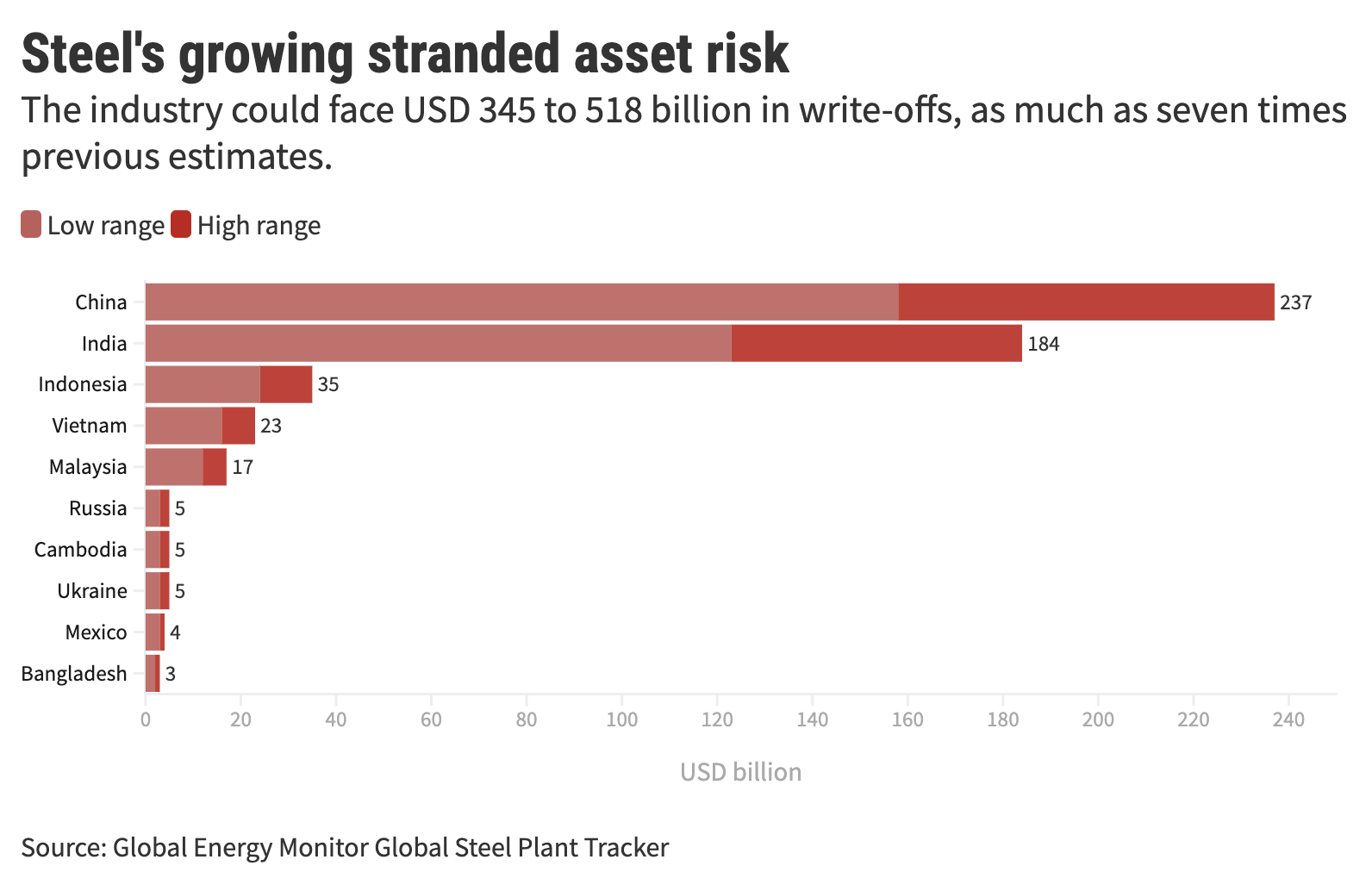

San Francisco, CA – The steel industry could face USD 518 billion in stranded asset risk as countries work toward meeting their long-term carbon neutrality commitments, if the 345.3 million tonnes per annum (mtpa) of emissions-heavy blast furnace basic oxygen furnace capacity (BF-BOF) proposed or under construction is fully developed, according to new data from Global Energy Monitor’s Global Steel Plant Tracker.

Much of this stranded asset risk is concentrated in Asia: 80% of the BF-BOF steelmaking capacity under development globally is planned in China (158 mtpa with up to USD 237 billion at risk) and India (123 mtpa; up to USD 184 billion). An additional 14% of the BF-BOF steelmaking capacity under development is planned for Indonesia (24 mtpa, USD 35 billion), Vietnam (16 mtpa, USD 23 billion), and Malaysia (12 mtpa, USD 17 billion).

Yet progress towards decarbonizing the sector by replacing BF-BOF steelmaking with less emissions-intensive electric arc furnace (EAF) technology is stagnant. According to the International Energy Agency’s Net-zero by 2050 scenario, the share of EAF steelmaking capacity should reach 37% by 2030 and 53% by 2050. This target requires an additional 576 mtpa EAF capacity while at the same time canceling or retiring 419 mtpa BOF capacity.

According to data in the Global Steel Plant Tracker, the shares of capacity by steelmaking technology would only shift from 69% BOF and 31% EAF in 2022 to 68% BOF and 32% EAF in 2030, and remain approximately the same through to 2050.

The report also finds that emissions estimates for steelmaking fail to account for the impact of metallurgical coal mining. The steel industry currently emits approximately 2.6 gigatonnes (Gt) of direct CO2 emissions per year and 1.1 Gt of indirect CO2 emissions from the power sector and combustion of steel off-gasses. If the methane emissions from metallurgical coal mining are accounted for in global assessments of steelmaking emissions, the footprint of the steel industry may be as much as 27% (1 Gt CO2-e20) higher than currently reported.

“Transitioning to less carbon-intensive steelmaking is a big part of countries meeting their net zero goals,” said Caitlin Swalec, Project Manager for the Global Steel Plant Tracker. “We need to stop investing in coal-based blast furnace basic oxygen equipment and speed up the shift towards electric arc furnace steelmaking.”

Contacts

Caitlin Swalec, +1-207-356-5056, [email protected]

Additional resources

See here for additional tables showing stranded asset risks for companies with the most BF-BOF capacity under development, a breakdown of proposed capacity by G7 and non-G7 countries, and a table of countries with the most EAF steelmaking capacity in development.

About the Global Steel Plant Tracker

The Global Steel Plant Tracker covers 2,208 mtpa operating crude steelmaking capacity, approximately 90% of global capacity according to OECD estimates. It also covers 1,417 mtpa operating BF capacity and 123 mtpa operating direct reduced iron capacity, approximately 89% and 90% of global capacity, respectively, making this the most up-to-date comprehensive tracker of global steel capacity developments.

###

Global Energy Monitor (GEM) develops and shares information on fossil fuel projects in support of the worldwide movement for clean energy. Current projects include the Global Coal Plant Tracker, the Global Coal Mine Tracker, the Global Steel Plant Tracker, the Global Fossil Infrastructure Tracker, the Europe Gas Tracker, the CoalWire newsletter, and the GEM wiki. For more information, visit www.globalenergymonitor.org